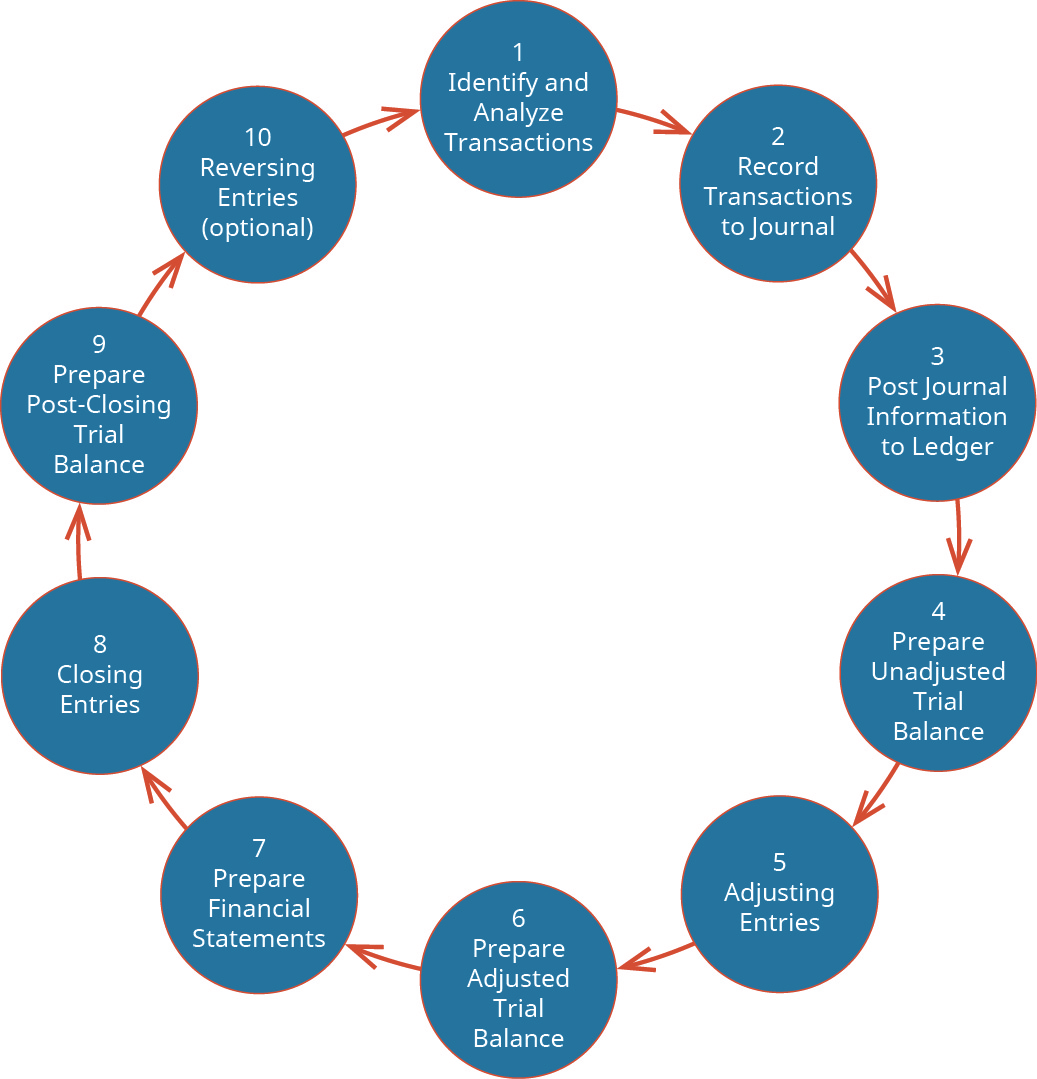

We have gone through the entire accounting cycle for Printing Plus with the steps spread over three chapters. Let’s go through the complete accounting cycle for another company here. The full accounting cycle diagram is presented in Figure 1.33.

We next take a look at a comprehensive example that works through the entire accounting cycle for Clip’em Cliff. Clifford Girard retired from the US Marine Corps after 20 years of active duty. Cliff decides it would be fun to become a barber and open his own shop called “Clip’em Cliff.” He will run the barber shop out of his home for the first couple of months while he identifies a new location for his shop.

Since his Marines career included several years of logistics, he is also going to operate a consulting practice where he will help budding barbers create a barbering practice. He will charge a flat fee or a per hour charge. His consulting practice will be recognized as service revenue and will provide additional revenue while he develops his barbering practice.

He obtains a barber’s license after the required training and is ready to open his shop on August 1. Table 1.3 shows his transactions from the first month of business.

| Date | Transaction |

|---|---|

| Aug. 1 | Cliff issues $70,000 shares of common stock for cash. |

| Aug. 3 | Cliff purchases barbering equipment for $45,000; $37,500 was paid immediately with cash, and the remaining $7,500 was billed to Cliff with payment due in 30 days. He decided to buy used equipment, because he was not sure if he truly wanted to run a barber shop. He assumed that he will replace the used equipment with new equipment within a couple of years. |

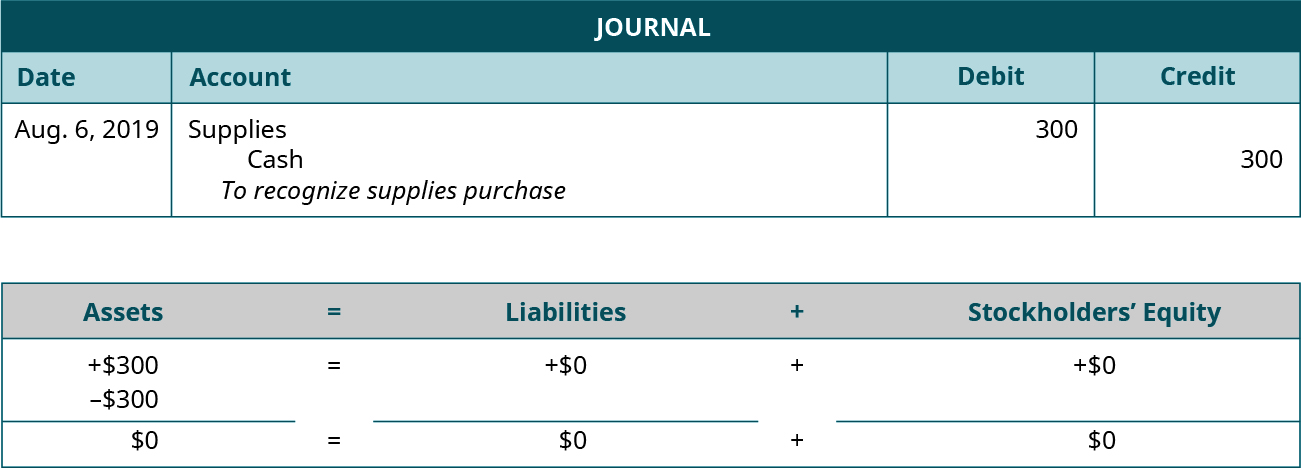

| Aug. 6 | Cliff purchases supplies for $300 cash. |

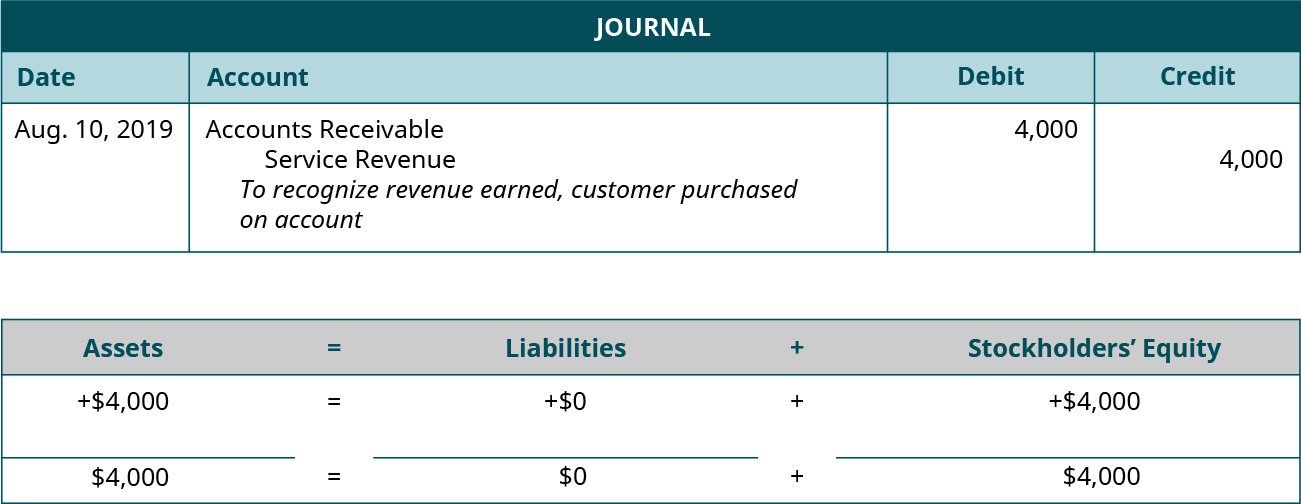

| Aug. 10 | Cliff provides $4,000 in services to a customer who asks to be billed for the services. |

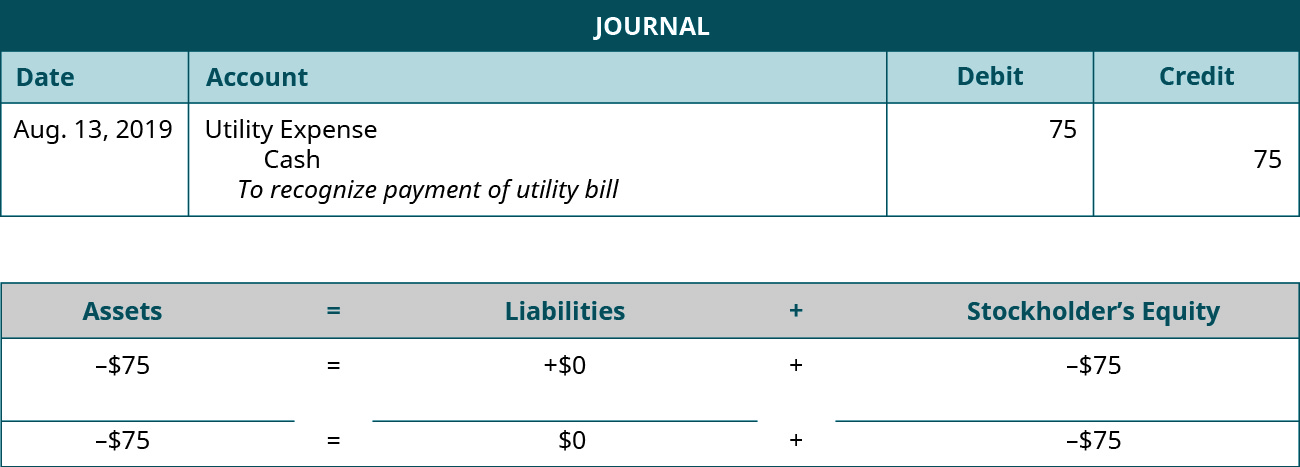

| Aug. 13 | Cliff pays a $75 utility bill with cash. |

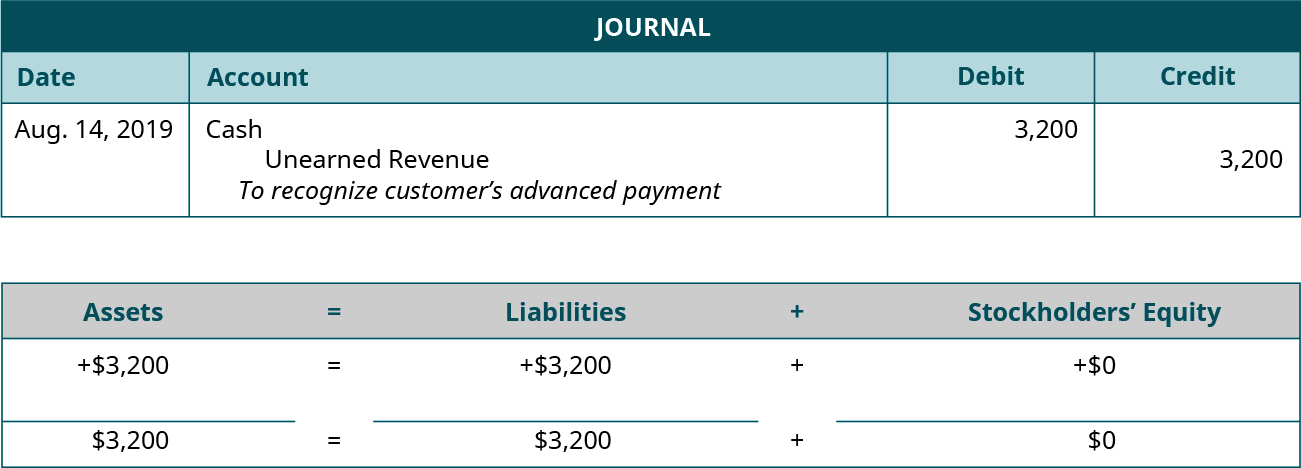

| Aug. 14 | Cliff receives $3,200 cash in advance from a customer for services not yet rendered. |

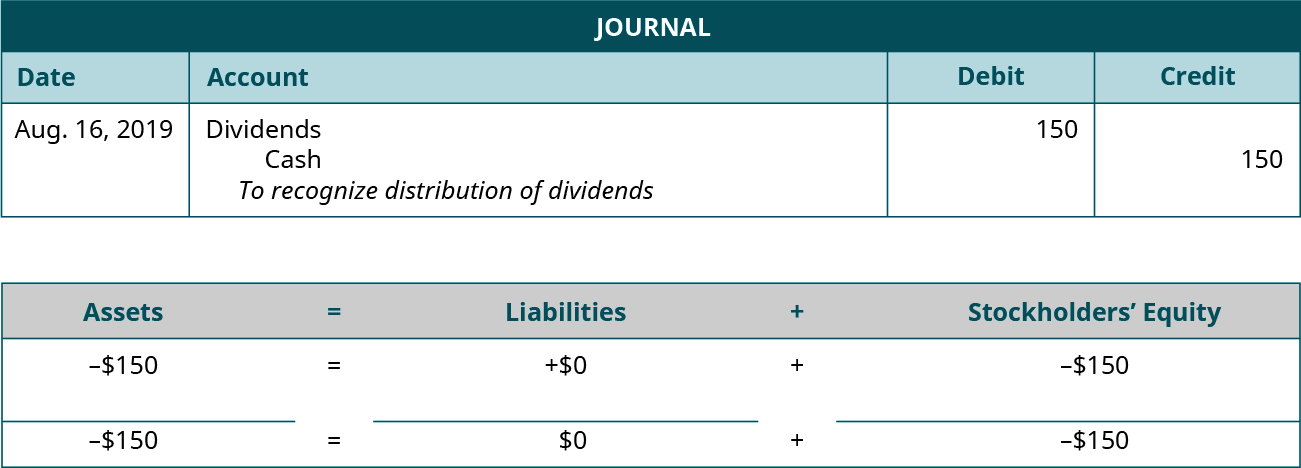

| Aug. 16 | Cliff distributed $150 cash in dividends to stockholders. |

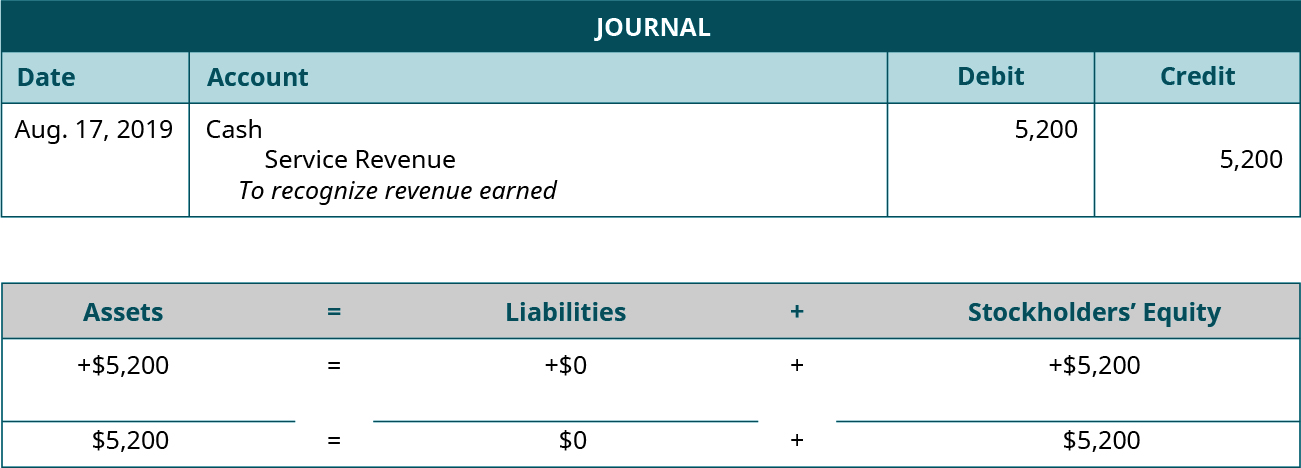

| Aug. 17 | Cliff receives $5,200 cash from a customer for services rendered. |

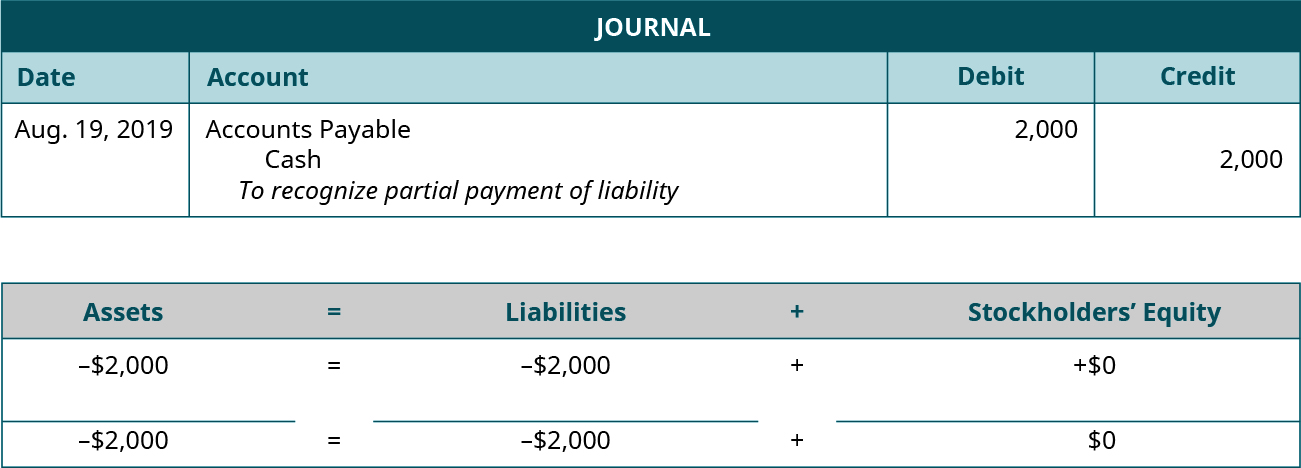

| Aug. 19 | Cliff paid $2,000 toward the outstanding liability from the August 3 transaction. |

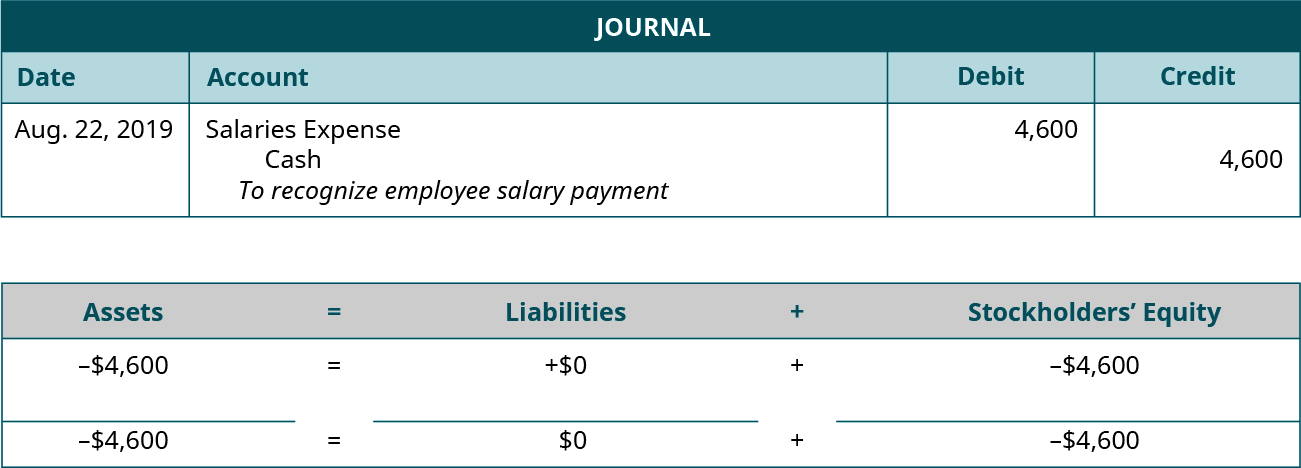

| Aug. 22 | Cliff paid $4,600 cash in salaries expense to employees. |

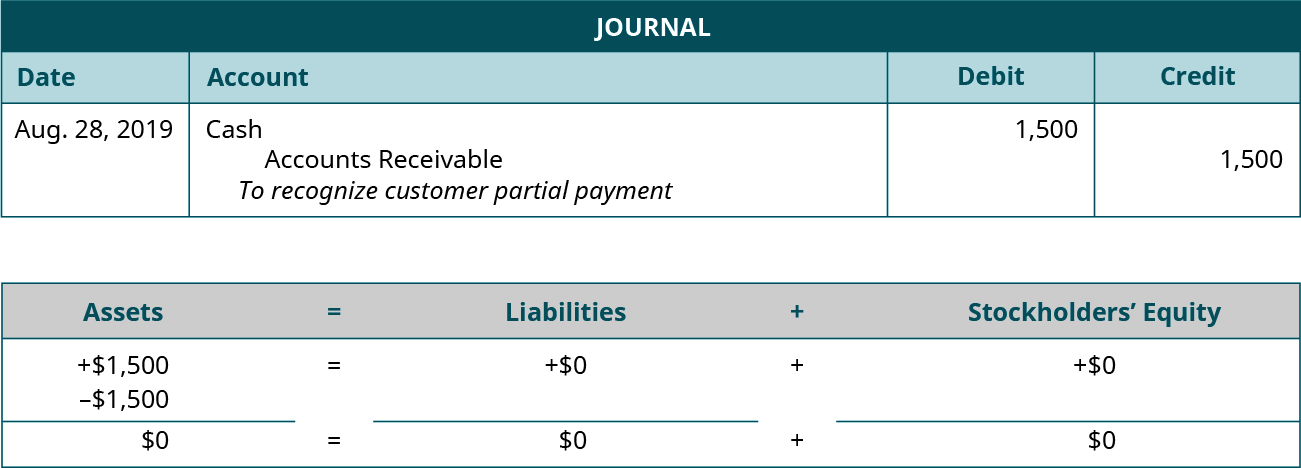

| Aug. 28 | The customer from the August 10 transaction pays $1,500 cash toward Cliff’s account. |

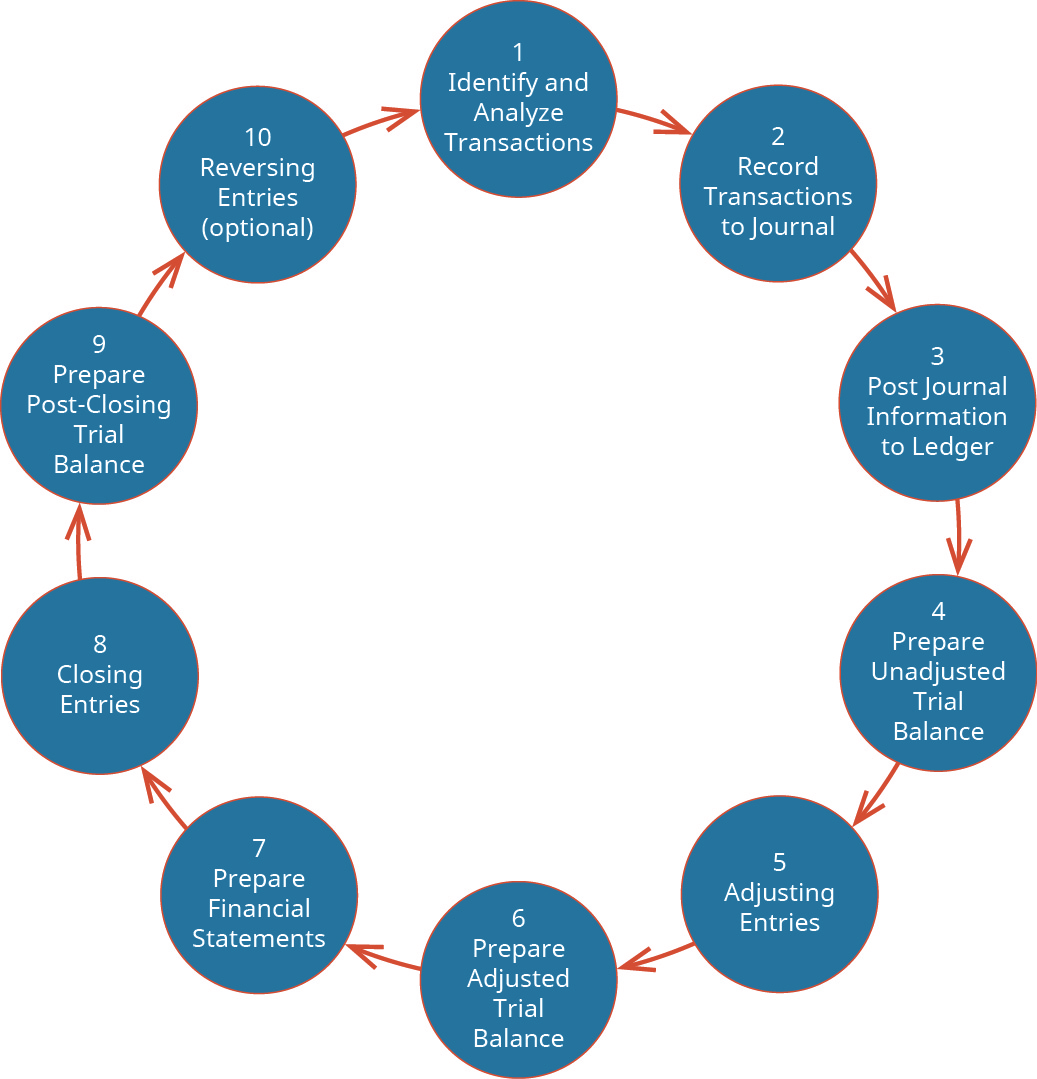

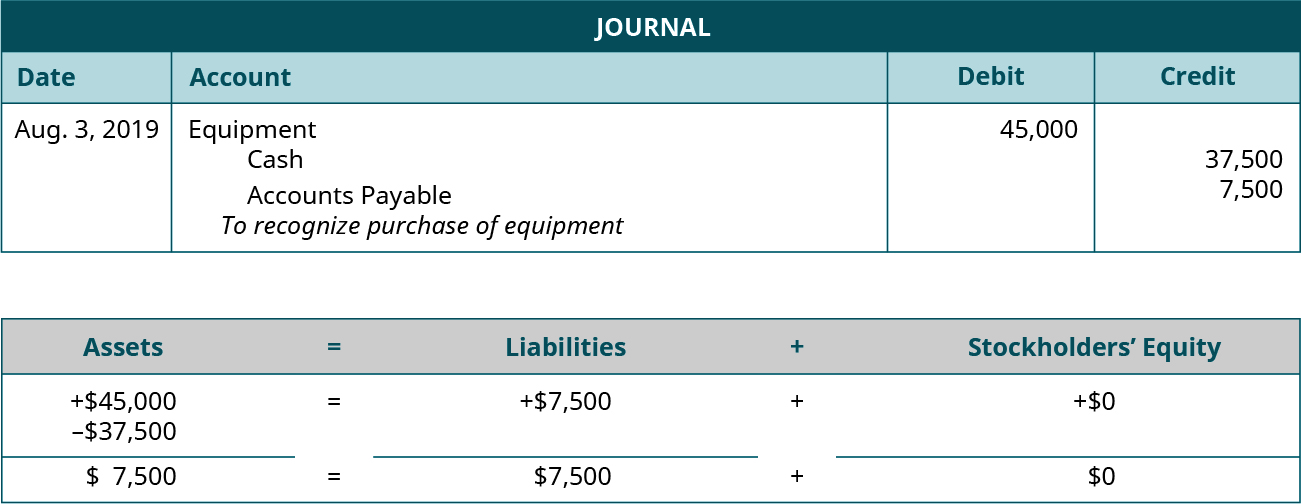

Transaction 1: On August 1, 2019, Cliff issues $70,000 shares of common stock for cash.

Analysis:

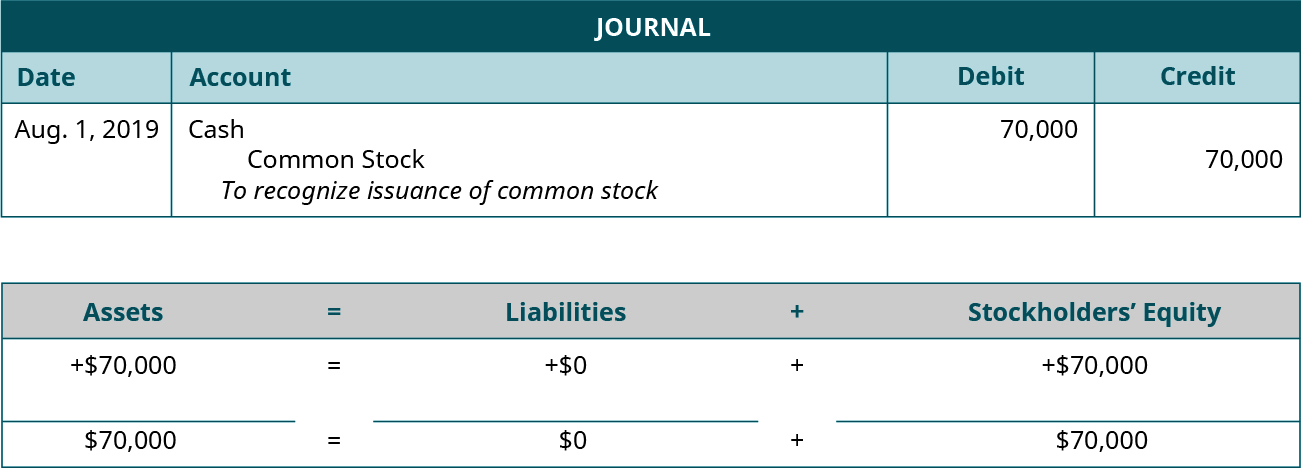

Transaction 2: On August 3, 2019, Cliff purchases barbering equipment for $45,000; $37,500 was paid immediately with cash, and the remaining $7,500 was billed to Cliff with payment due in 30 days.

Analysis:

Transaction 3: On August 6, 2019, Cliff purchases supplies for $300 cash.

Analysis:

Transaction 4: On August 10, 2019, provides $4,000 in services to a customer who asks to be billed for the services.

Analysis:

Transaction 5: On August 13, 2019, Cliff pays a $75 utility bill with cash.

Analysis:

Transaction 6: On August 14, 2019, Cliff receives $3,200 cash in advance from a customer for services to be rendered.

Analysis:

Transaction 7: On August 16, 2019, Cliff distributed $150 cash in dividends to stockholders.

Analysis:

Transaction 8: On August 17, 2019, Cliff receives $5,200 cash from a customer for services rendered.

Analysis:

Transaction 9: On August 19, 2019, Cliff paid $2,000 toward the outstanding liability from the August 3 transaction.

Analysis:

Transaction 10: On August 22, 2019, Cliff paid $4,600 cash in salaries expense to employees.

Analysis:

Transaction 11: On August 28, 2019, the customer from the August 10 transaction pays $1,500 cash toward Cliff’s account.

Analysis:

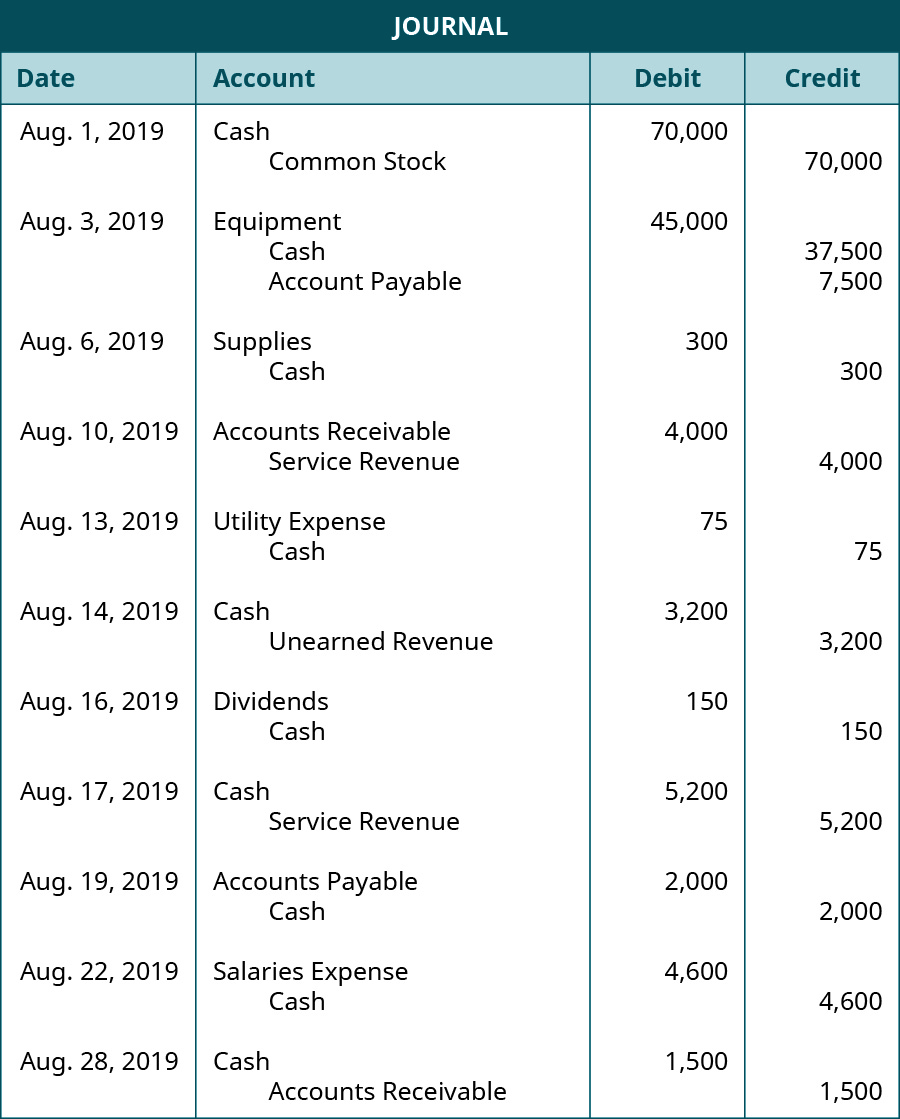

The complete journal for August is presented in Figure 1.34.

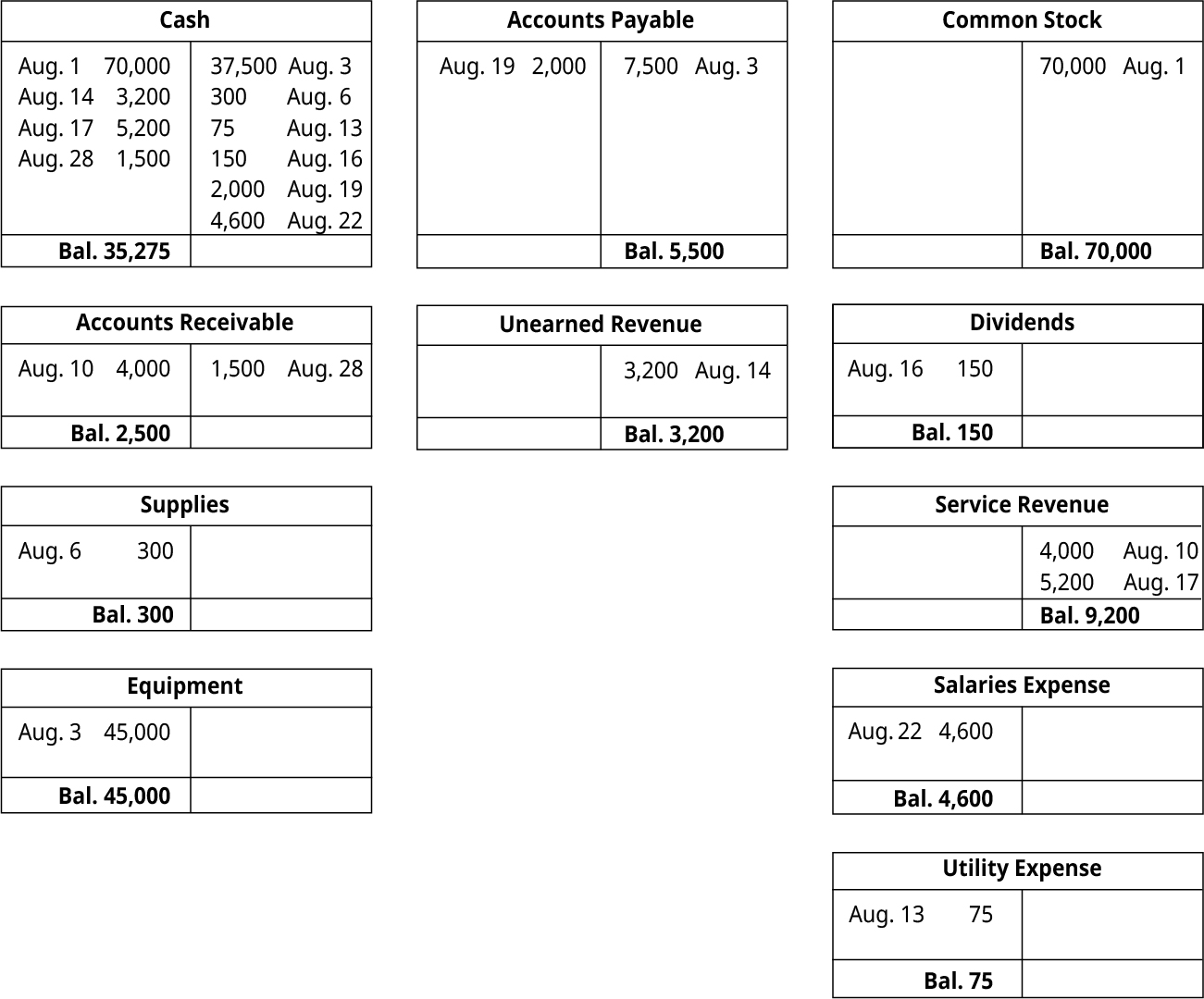

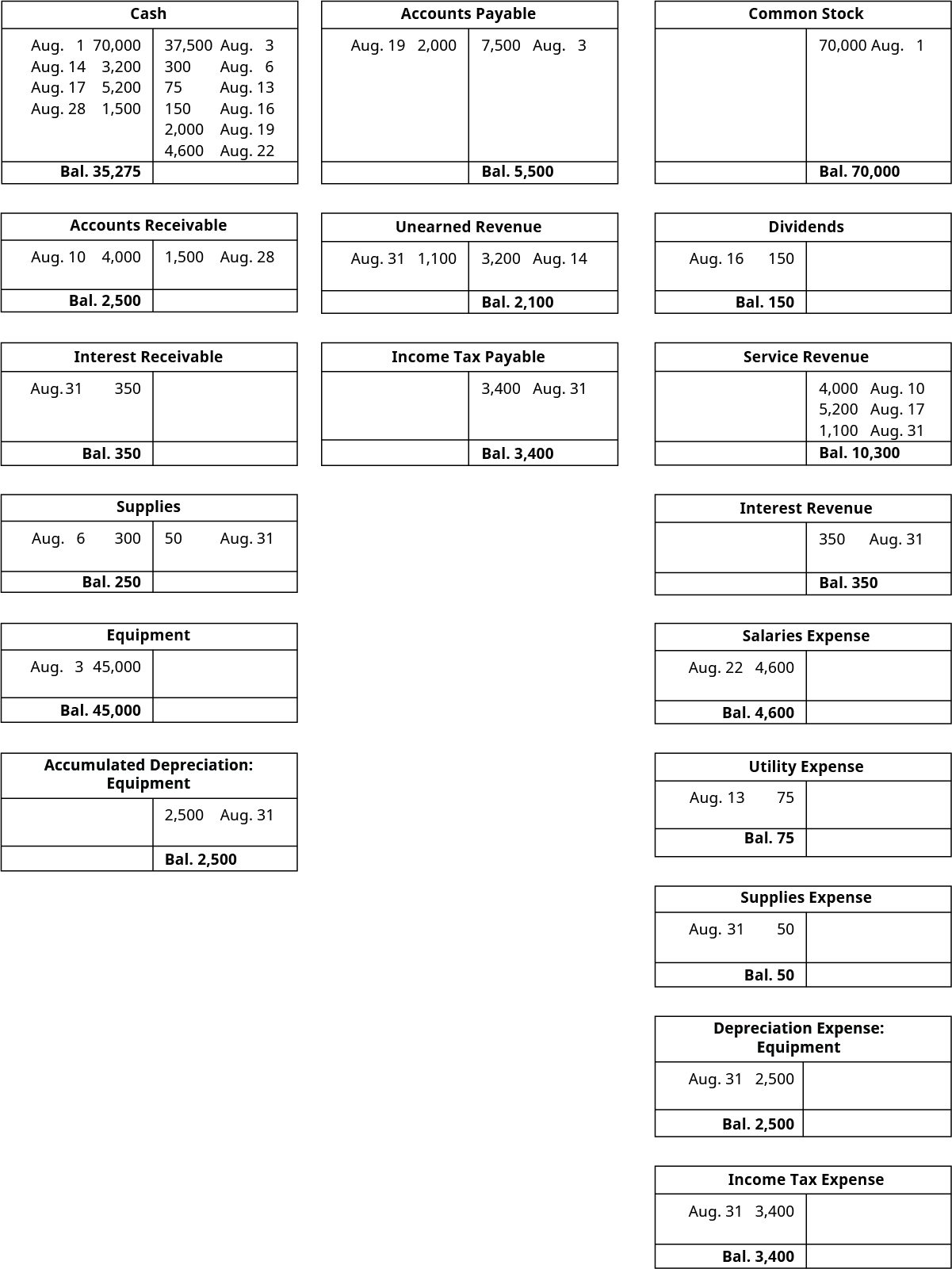

Once all journal entries have been created, the next step in the accounting cycle is to post journal information to the ledger. The ledger is visually represented by T-accounts. Cliff will go through each transaction and transfer the account information into the debit or credit side of that ledger account. Any account that has more than one transaction needs to have a final balance calculated. This happens by taking the difference between the debits and credits in an account.

Clip’em Cliff’s ledger represented by T-accounts is presented in Figure 1.35.

You will notice that the sum of the asset account balances in Cliff’s ledger equals the sum of the liability and equity account balances at $83,075. The final debit or credit balance in each account is transferred to the unadjusted trial balance in the corresponding debit or credit column as illustrated in Figure 1.36.

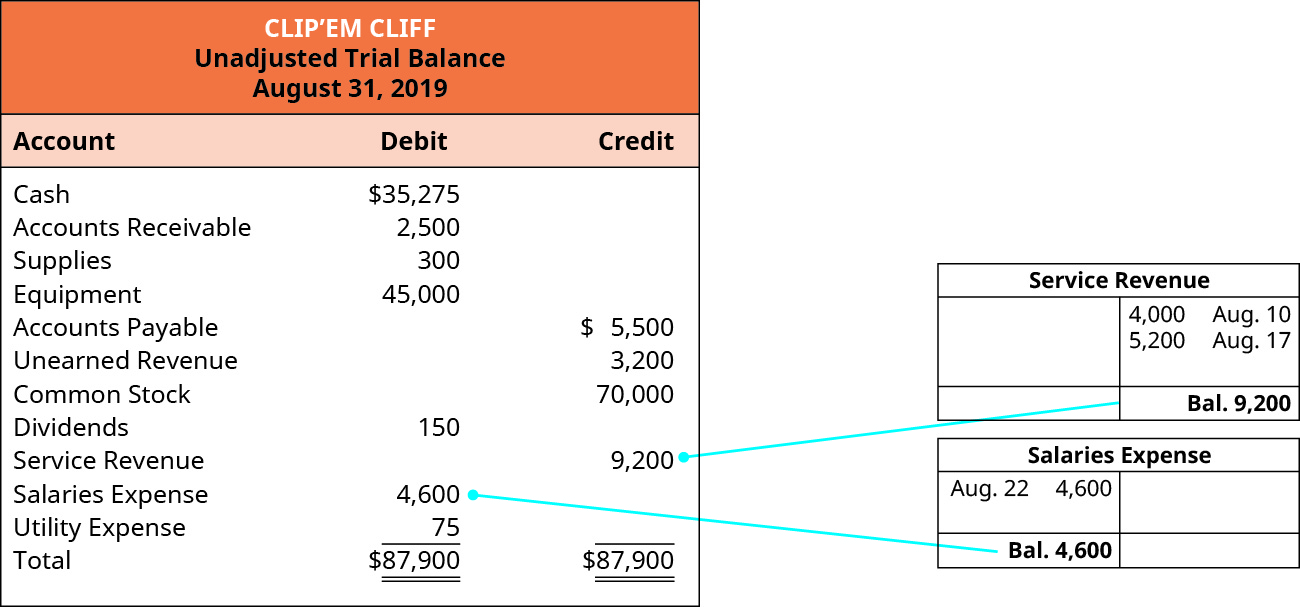

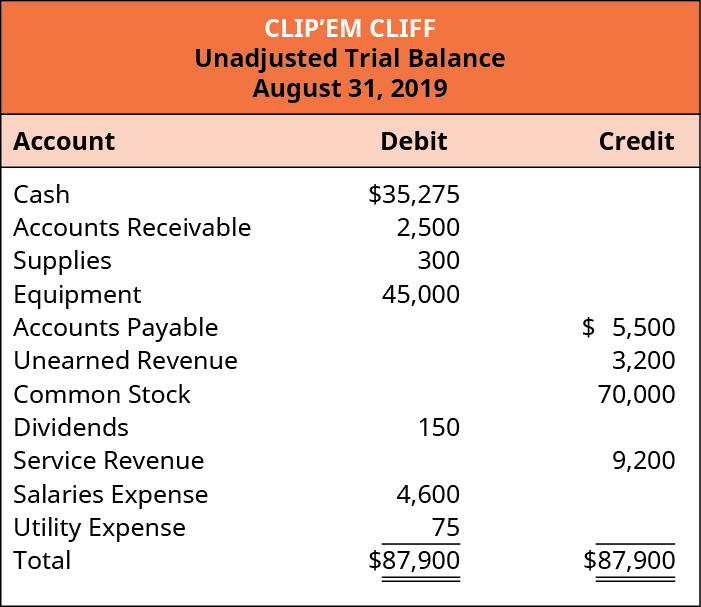

Once all of the account balances are transferred to the correct columns, each column is totaled. The total in the debit column must match the total in the credit column to remain balanced. The unadjusted trial balance for Clip’em Cliff appears in Figure 1.37.

The unadjusted trial balance shows a debit and credit balance of $87,900. Remember, the unadjusted trial balance is prepared before any period-end adjustments are made.

On August 31, Cliff has the transactions shown in Table 1.4 requiring adjustment.

| Date | Transaction |

|---|---|

| Aug. 31 | Cliff took an inventory of supplies and discovered that $250 of supplies remain unused at the end of the month. |

| Aug. 31 | The equipment purchased on August 3 depreciated $2,500 during the month of August. |

| Aug. 31 | Clip’em Cliff performed $1,100 of services during August for the customer from the August 14 transaction. |

| Aug. 31 | Reviewing the company bank statement, Clip’em Cliff discovers $350 of interest earned during the month of August that was previously uncollected and unrecorded. As a new customer for the bank, the interest was paid by a bank that offered an above-market-average interest rate. |

| Aug. 31 | Unpaid and previously unrecorded income taxes for the month are $3,400. The tax payment was to cover his federal quarterly estimated income taxes. He lives in a state that does not have an individual income tax |

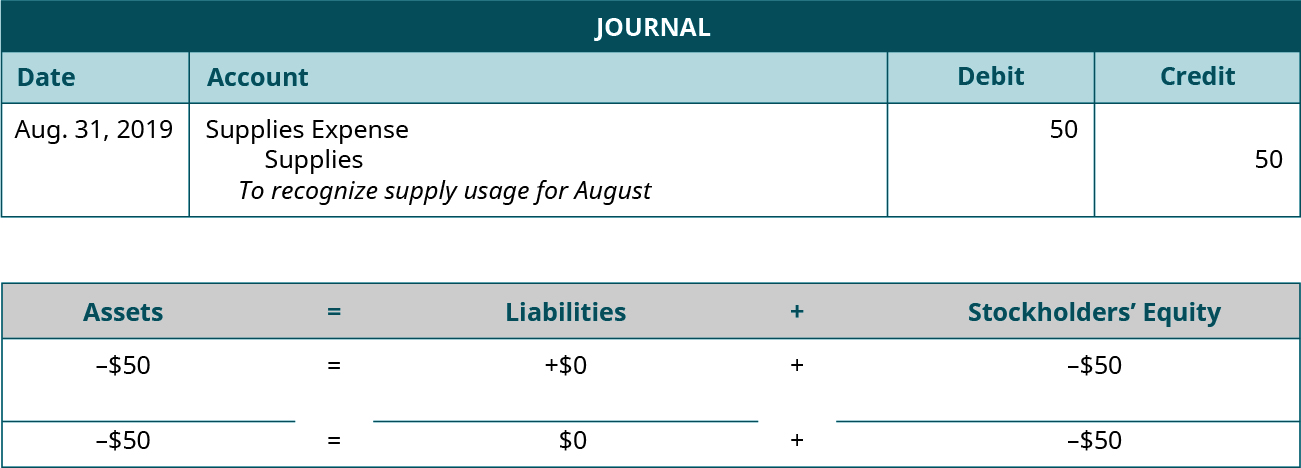

Adjusting Transaction 1: Cliff took an inventory of supplies and discovered that $250 of supplies remain unused at the end of the month.

Analysis:

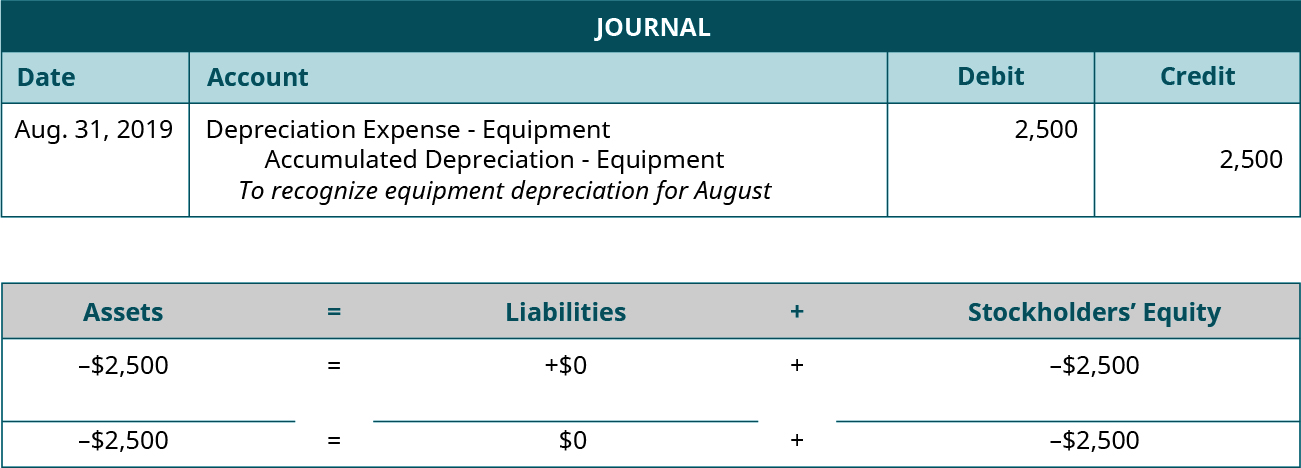

Adjusting Transaction 2: The equipment purchased on August 3 depreciated $2,500 during the month of August.

Analysis:

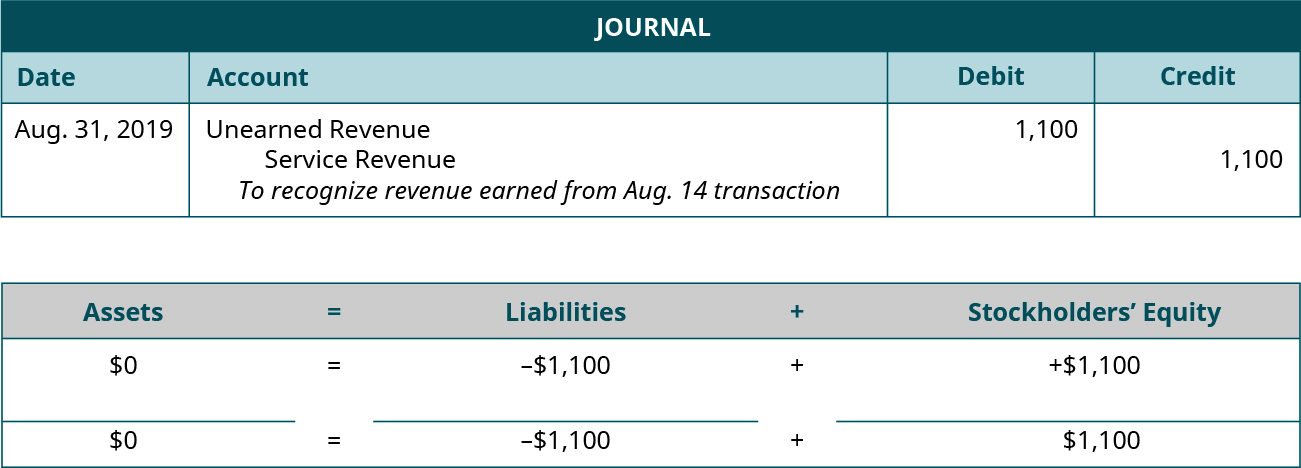

Adjusting Transaction 3: Clip’em Cliff performed $1,100 of services during August for the customer from the August 14 transaction.

Analysis:

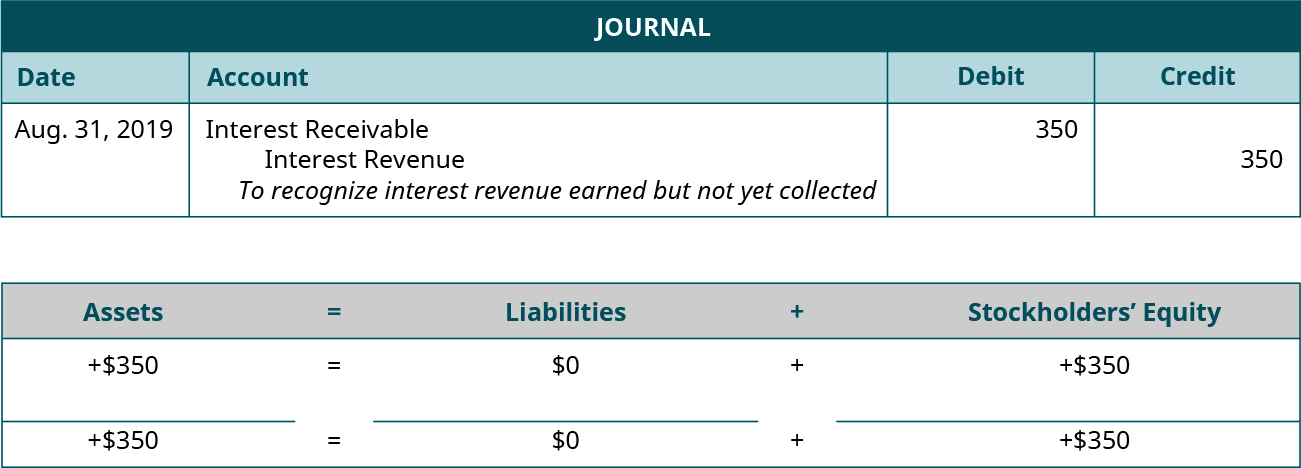

Adjusting Transaction 4: Reviewing the company bank statement, Clip’em Cliff identifies $350 of interest earned during the month of August that was previously unrecorded.

Analysis:

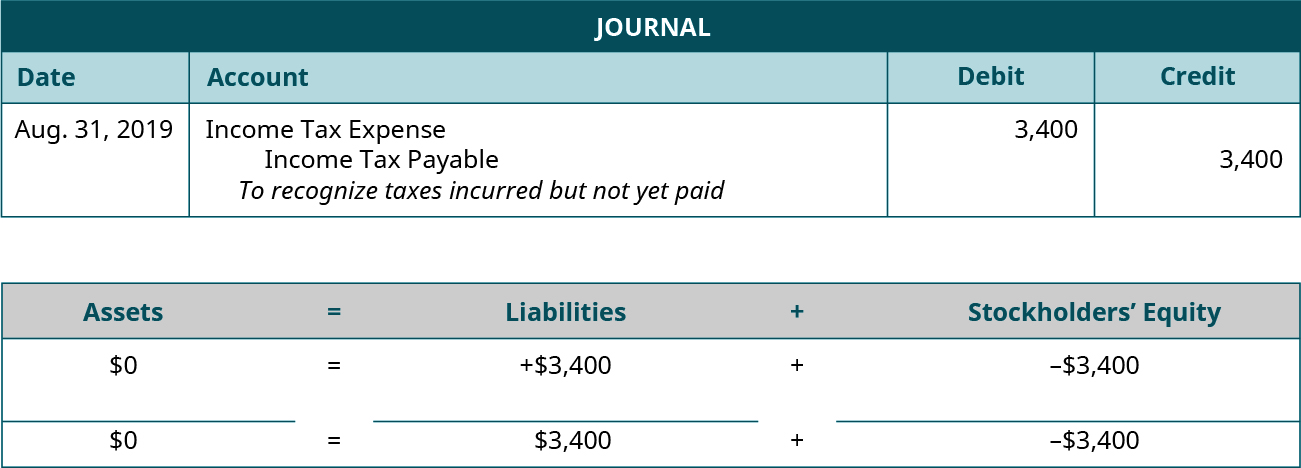

Adjusting Transaction 5: Unpaid and previously unrecorded income taxes for the month are $3,400.

Analysis:

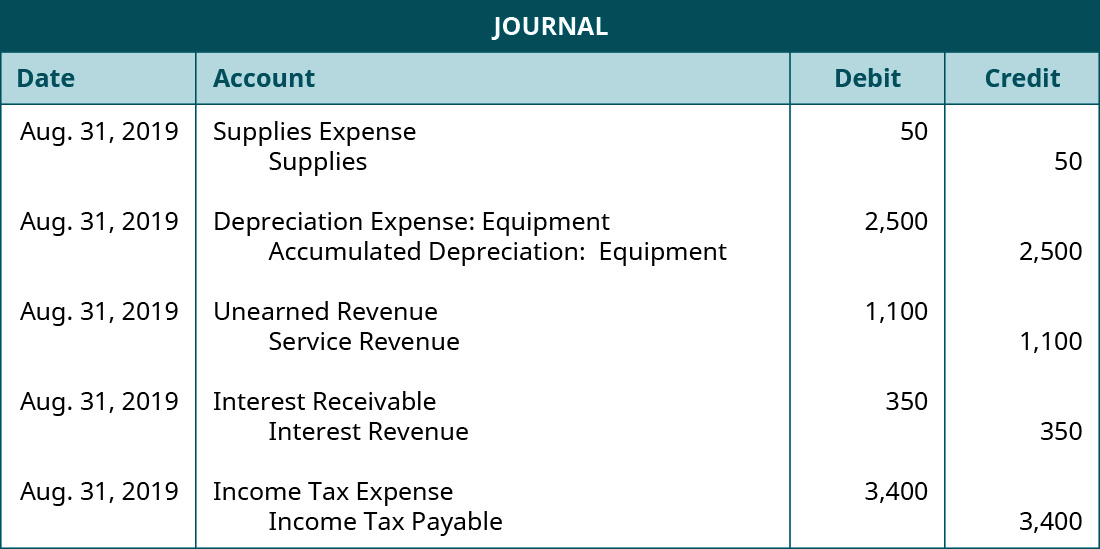

The summary of adjusting journal entries for Clip’em Cliff is presented in Figure 1.38.

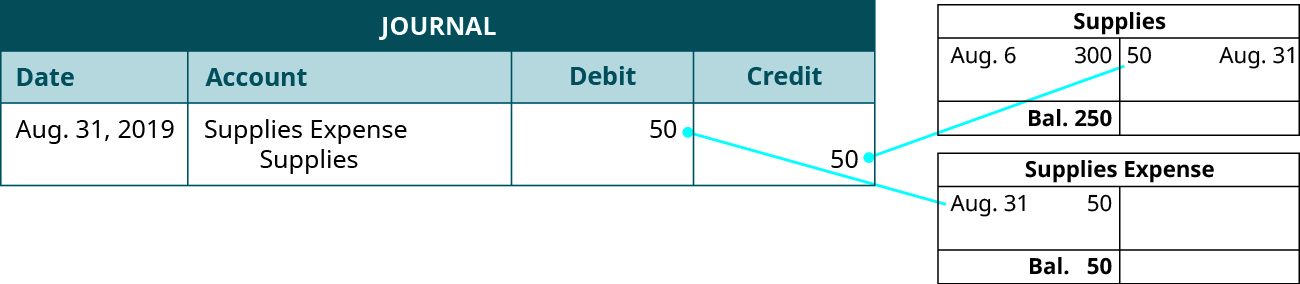

Now that all of the adjusting entries are journalized, they must be posted to the ledger. Posting adjusting entries is the same process as posting the general journal entries. Each journalized account figure will transfer to the corresponding ledger account on either the debit or credit side as illustrated in Figure 1.39.

We would normally use a general ledger, but for illustrative purposes, we are using T-accounts to represent the ledgers. The T-accounts after the adjusting entries are posted are presented in Figure 1.40.

You will notice that the sum of the asset account balances equals the sum of the liability and equity account balances at $80,875. The final debit or credit balance in each account is transferred to the adjusted trial balance, the same way the general ledger transferred to the unadjusted trial balance.

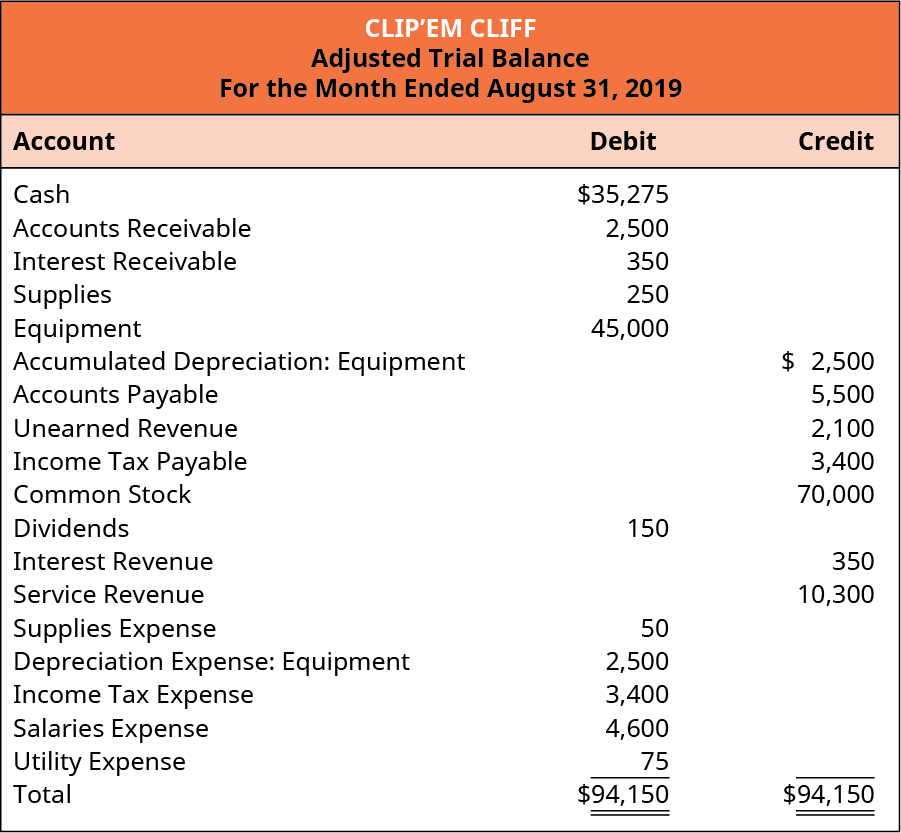

The next step in the cycle is to prepare the adjusted trial balance. Clip’em Cliff’s adjusted trial balance is shown in Figure 1.41.

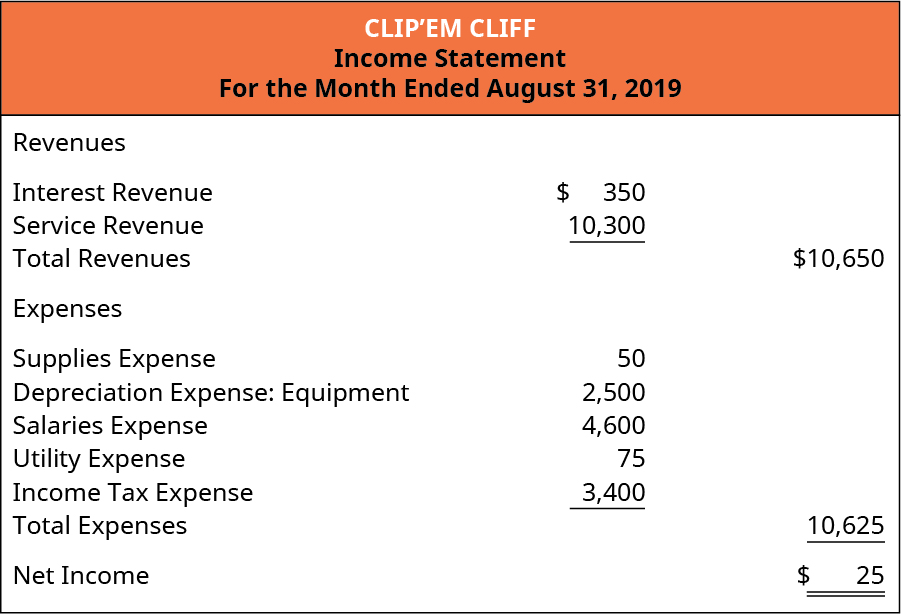

The adjusted trial balance shows a debit and credit balance of $94,150. Once the adjusted trial balance is prepared, Cliff can prepare his financial statements (step 7 in the cycle). We only prepare the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is discussed in detail in Statement of Cash Flows.

To prepare your financial statements, you want to work with your adjusted trial balance.

Remember, revenues and expenses go on an income statement. Dividends, net income (loss), and retained earnings balances go on the statement of retained earnings. On a balance sheet you find assets, contra assets, liabilities, and stockholders’ equity accounts.

The income statement for Clip’em Cliff is shown in Figure 1.42.

Note that expenses were only $25 less than revenues. For the first month of operations, Cliff welcomes any income. Cliff will want to increase income in the next period to show growth for investors and lenders.

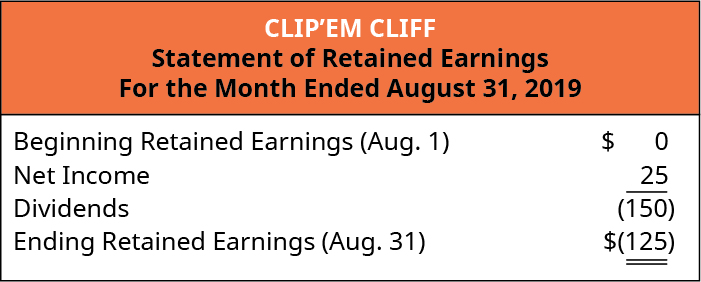

Next, Cliff prepares the following statement of retained earnings (Figure 1.43).

The beginning retained earnings balance is zero because Cliff just began operations and does not have a balance to carry over to a future period. The ending retained earnings balance is –$125. You probably never want to have a negative value on your retained earnings statement, but this situation is not totally unusual for an organization in its initial operations. Cliff will want to improve this outcome going forward. It might make sense for Cliff to not pay dividends until he increases his net income.

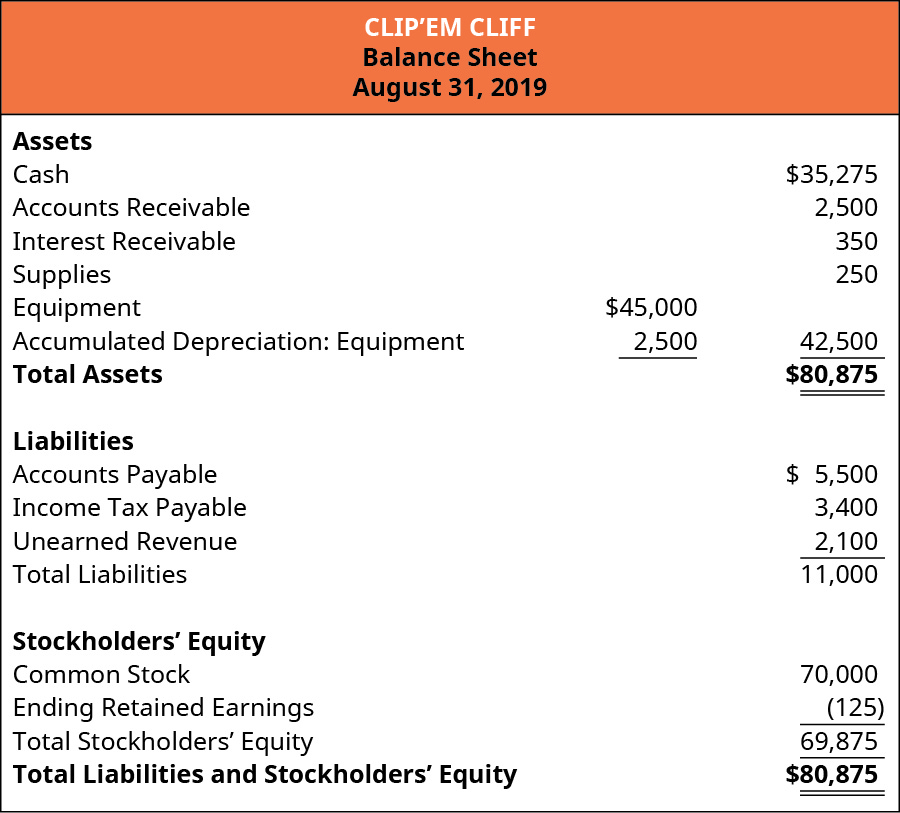

Cliff then prepares the balance sheet for Clip’em Cliff as shown in Figure 1.44.

The balance sheet shows total assets of $80,875, which equals total liabilities and equity. Now that the financial statements are complete, Cliff will go to the next step in the accounting cycle, preparing and posting closing entries. To do this, Cliff needs his adjusted trial balance information.

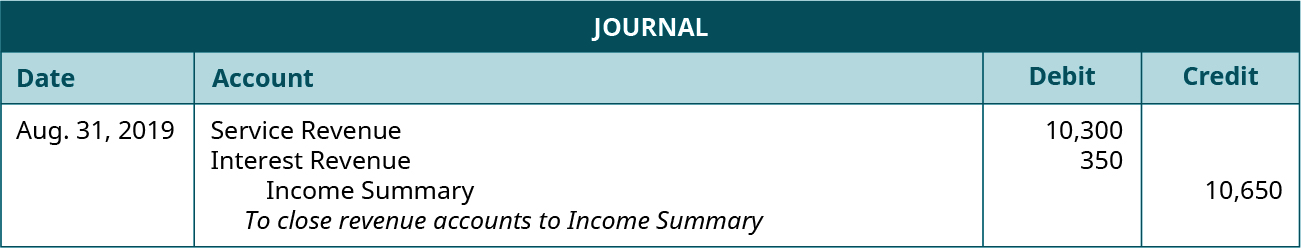

Cliff will only close temporary accounts, which include revenues, expenses, income summary, and dividends. The first entry closes revenue accounts to income summary. To close revenues, Cliff will debit revenue accounts and credit income summary.

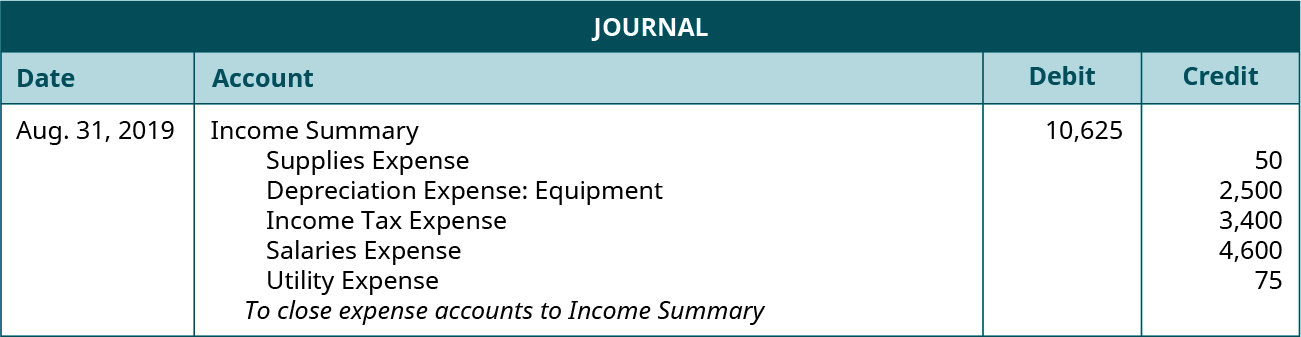

The second entry closes expense accounts to income summary. To close expenses, Cliff will credit expense accounts and debit income summary.

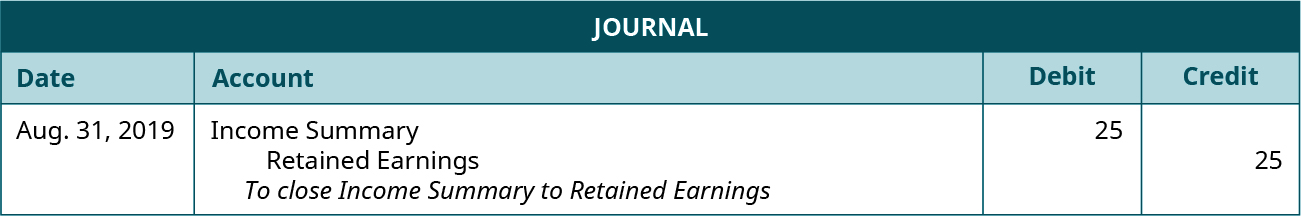

The third entry closes income summary to retained earnings. To find the balance, take the difference between the income summary amount in the first and second entries (10,650 – 10,625). To close income summary, Cliff would debit Income Summary and credit Retained Earnings.

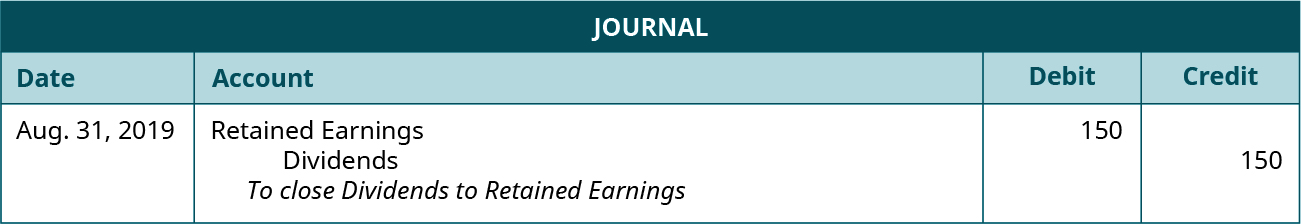

The fourth closing entry closes dividends to retained earnings. To close dividends, Cliff will credit Dividends, and debit Retained Earnings.

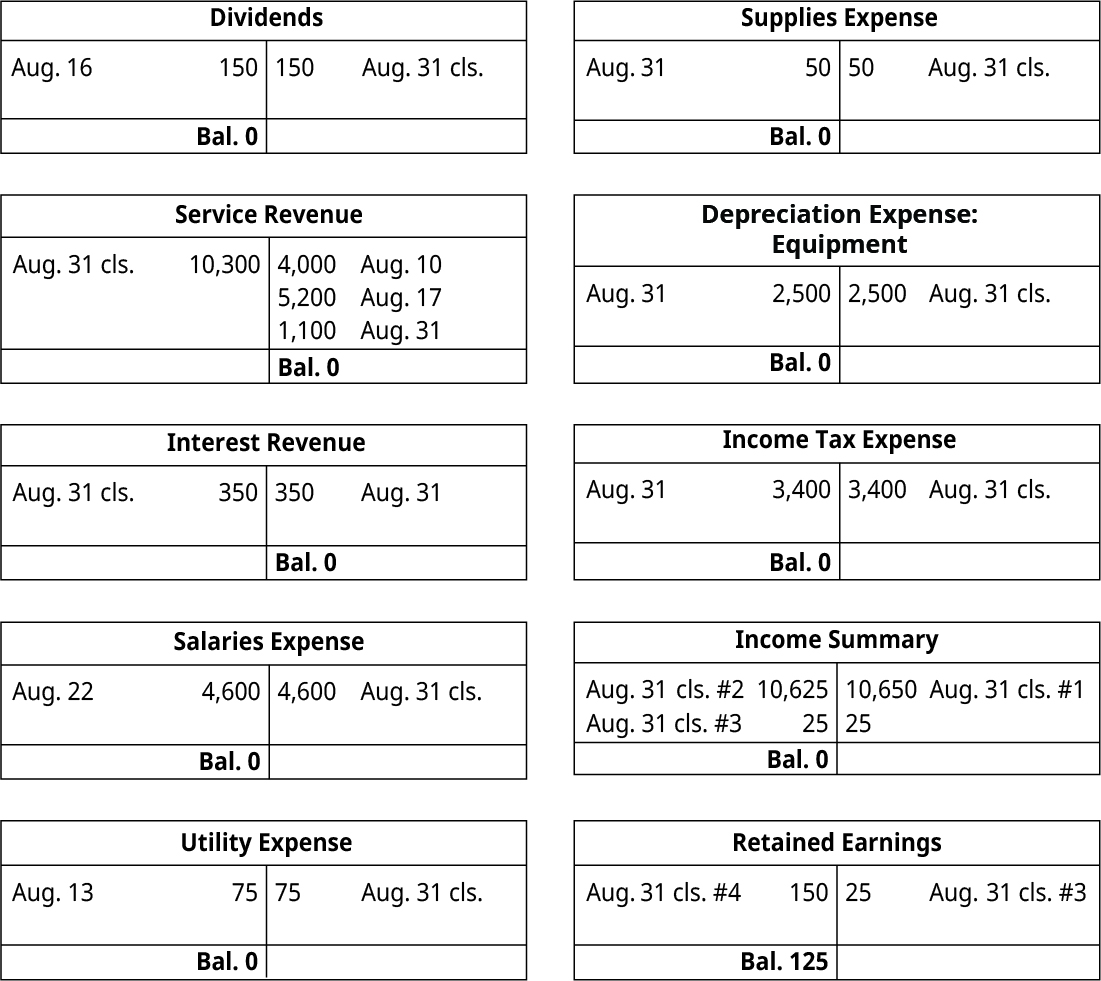

Once all of the closing entries are journalized, Cliff will post this information to the ledger. The closed accounts with their final balances, as well as Retained Earnings, are presented in Figure 1.45.

Now that the temporary accounts are closed, they are ready for accumulation in the next period.

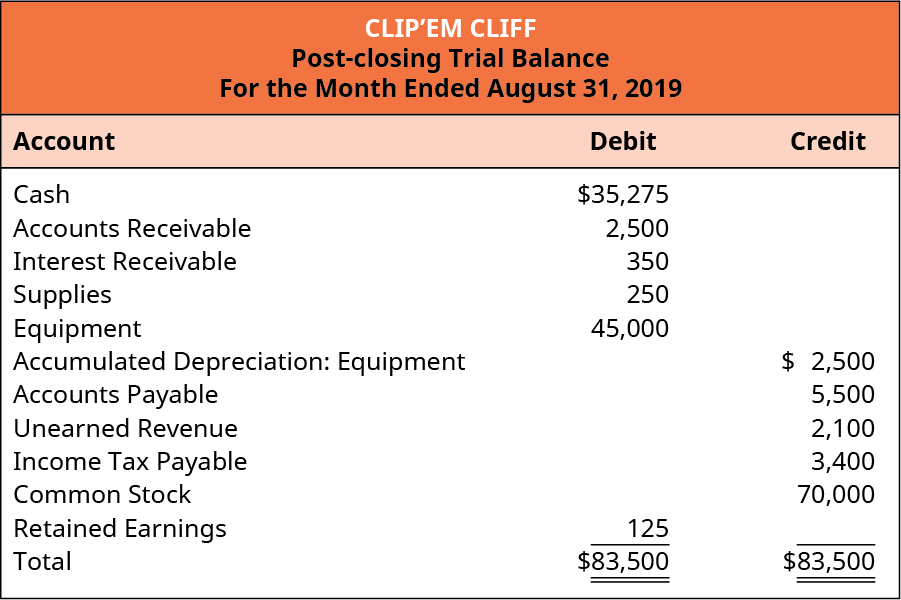

The last step for the month of August is step 9, preparing the post-closing trial balance. The post-closing trial balance should only contain permanent account information. No temporary accounts should appear on this trial balance. Clip’em Cliff’s post-closing trial balance is presented in Figure 1.46.

At this point, Cliff has completed the accounting cycle for August. He is now ready to begin the process again for September, and future periods.

One step in the accounting cycle that we did not cover is reversing entries. Reversing entries can be made at the beginning of a new period to certain accruals. The company will reverse adjusting entries made in the prior period to the revenue and expense accruals.

It can be difficult to keep track of accruals from prior periods, as support documentation may not be readily available in current or future periods. This requires an accountant to remember when these accruals came from. By reversing these accruals, there is a reduced risk for counting revenues and expenses twice. The support documentation received in the current or future period for an accrual will be easier to match to prior revenues and expenses with the reversal.

A large circle labeled, in the center, The Accounting Cycle. The large circle consists of 10 smaller circles with arrows pointing from one smaller circle to the next one. The smaller circles are labeled, in clockwise order: 1 Identify and Analyze Transactions; 2 Record Transactions to Journal; 3 Post Journal Information to Ledger; 4 Prepare Unadjusted Trial Balance; 5 Adjusting Entries; 6 Prepare Adjusted Trial Balance; 7 Prepare Financial Statements; 8 Closing Entries; 9 Prepare Post-Closing Trial Balance; 10 Reversing Entries (optional). Return

Journal entries. August 1, 2019 debit Cash and credit Common Stock for 70,000. August 3, 2019 debit Equipment for 45,000 and credit Cash for 37,500 and Accounts Payable for 7,500. August 6, 2019 debit Supplies and credit Cash for 300. August 10, 2019 debit Accounts Receivable and credit Service Revenue for 4,000. August 13, 2019 debit Utilities Expense and credit Cash for 75. August 14, 2019 debit Cash 3,200 and credit Unearned Revenue for 3,200. August 16, 2019 debit Dividends and credit Cash for 150. August 17, 2019 debit Cash and credit Service Revenue for 5,200. August 19, 2019 debit Accounts Payable and credit Cash for 2,000. August 22, 2019 debit Salaries Expense and credit Cash for 4,600. August 28, 2019 debit Cash and credit Accounts Receivable for 1,500. Return

Cash has an August 1 debit entry of 70,000, an August 3 credit entry of 37,500, an August 6 credit entry of 300, an v 13 credit entry of 75, a August 14 debit entry of 3,200, an August 16 credit entry of 150, an August 17 debit entry of 5,200, an August 19 credit entry of 2,000, an August 22 credit entry of 4,600, and an August 28 debit entry of 1,500, leaving a debit balance of 35,275. Accounts Receivable has an August 10 debit entry of 4,000, an August 28 credit entry of 1,500, and a debit balance of 2,500. Supplies has an August 6 debit entry of 300 and a debit balance of 300. Equipment has an August 3 debit entry of 45,000 and a debit balance of 45,000. Accounts Payable has an August 3 credit entry of 7,500, an August 19 debit entry of 2,000 and a credit balance of 5,500. Unearned Revenue has a credit August 14 entry of 3,200 and a credit balance of 3,200 Common Stock has an August 1 credit entry of 70,000 and a credit balance of 70,000. Dividends has an August 16 debit entry of 150, and a debit balance of 150. Service Revenue account has 2 entries on the credit side: August 10 4,000, and Aug 17 5,200. The total on the credit side is then 9,200. Salaries Expense has an August 22 debit side entry for 4,600 and a debit side balance of 4,600. Utilities Expense has an August 13 debit side entry for 75, and a debit side balance of 75. Return

Clip’em Cliff, Unadjusted Trial Balance, August 31, 2019. Cash 35,275 debit. Accounts receivable 2,500 debit. Supplies 300 debit. Equipment 45,000 debit. Accounts Payable 5,500 credit. Unearned Revenue 3,200 credit. Common Stock 70,000 credit. Dividends 150 debit. Service Revenue 9,200 credit. Salaries Expense 4,600 debit. Utility Expense 75 debit. Total debits and credits are each 87,900. The ledger pages for Service Revenue and Salaries Expense are showing their balances being put into the Unadjusted Trial Balance as an example for all the balances. Return

Clip’em Cliff, Unadjusted Trial Balance, August 31, 2019. Cash 35,275 debit. Accounts receivable 2,500 debit. Supplies 300 debit. Equipment 45,000 debit. Accounts Payable 5,500 credit. Unearned Revenue 3,200 credit. Common Stock 70,000 credit. Dividends 150 debit. Service Revenue 9,200 credit. Salaries Expense 4,600 debit. Utility Expense 75 debit. Total debits and credits are each 87,900. Return

Journal entries: August 31, 2019 debit Supplies Expense, credit Supplies 50. August 31, 2019 debit Depreciation Expense: Equipment, credit Accumulated Depreciation: Equipment 2,500. August 31, 2019 debit Unearned Revenue, credit Service revenue 1,100. August 31, 2019 debit Interest Receivable, credit Interest revenue 350. August 31, 2019 debit Income Tax Expense, credit Income Tax Payable 3,400. Return

Journal entry August 31, 2019 debit Supplies Expense, credit Supplies 50. There is an arrow from the debit 50 to the page from the Supplies Expense ledger account where that debit is shown on the debit side. There is an arrow from the credit 50 to the page from the Supplies ledger account where that credit is shown on the credit side (along with the August 6 debit of 300, resulting in a new balance of 250). Return

T-Accounts. Cash has an August 1 debit entry of 70,000, an August 3 credit entry of 37,500, an August 6 credit entry of 300, an August 13 credit entry of 75, a August 14 debit entry of 3,200, an August 16 credit entry of 150, an August 17 debit entry of 5,200, an August 19 credit entry of 2,000, an August 22 credit entry of 4,600, and an August 28 debit entry of 1,500, leaving a debit balance of 35,275. Accounts Receivable has an August 10 debit entry of 4,000, an August 28 credit entry of 1,500, and a debit balance of 2,500. Interest Receivable has an August 31 debit entry of 350 and a debit balance of 350. Supplies has an August 6 debit entry of 300, and August 31 credit entry of 50 and a debit balance of 250. Equipment has an August 3 debit entry of 45,000 and a debit balance of 45,000. Accumulated Depreciation has an August 31 credit entry of 2,500 and a credit balance of 2,500 Accounts Payable has an August 3 credit entry of 7,500, an August 19 debit entry of 2,000 and a credit balance of 5,500. Unearned Revenue has a credit August 14 entry of 3,200, an August 31 debit entry of 1,100 and a credit balance of 2,100. Income Tax Payable has an August 31 credit entry for 3,400 and a credit balance of 3,400. Common Stock has an August 1 credit entry of 70,000 and a credit balance of 70,000. Dividends has an August 16 debit entry of 150, and a debit balance of 150. Service Revenue account has 3 entries on the credit side: August 10 4,000, August 17 5,200, and August 31 of 1,100. The total on the credit side is then 10,300. Salaries Expense has an August 22 debit side entry for 4,600 and a debit side balance of 4,600. Utilities Expense has an August 13 debit side entry for 75, and a debit side balance of 75. Supplies Expense has a debit entry on August 31 of 50 and a debit balance of 50. Depreciation Expense: Equipment has a debit entry on August 31 of 2,500 and a debit balance of 2,500. Income Tax Expense has a debit entry on August 31 of 3,400 and a debit balance of 3,400. Return

Clip’em Cliff, Unadjusted Trial Balance, August 31, 2019. Cash 35,275 debit. Accounts receivable 2,500 debit. Interest receivable 350 debit. Supplies 250 debit. Equipment 45,000 debit. Accumulated Depreciation: Equipment 2,500 credit. Accounts Payable 5,500 credit. Unearned Revenue 2,100 credit. Income Tax Payable 3,400 credit. Common Stock 70,000 credit. Dividends 150 debit. Interest Revenue 350 credit. Service Revenue 10,300 credit. Supplies Expense 50 debit. Depreciation Expense: Equipment 2,500 debit. Income Tax Expense 3,400 debit. Salaries Expense 4,600 debit. Utility Expense 75 debit. Total debits and credits are each 94,150. Return

Clip’em Cliff, Income Statement, For the Month Ended August 31, 2019. Revenues: Interest revenue $350, Service Revenue 10,300. Total Revenues $10,650. Expenses: Supplies Expense 50, Depreciation Expense: Equipment 2,500, Salaries Expense 4,600, Utilities Expense 75, Income Tax Expense 3,400. Total Expenses 10,625. Net Income $25. Return

Clip’em Cliff, Statement of Retained Earnings, For the Month Ended August 31, 2019. Beginning Retained earnings (August 1) $0, Net Income 25 less Dividends 150 equals Ending Retained Earnings (August 31) (125). Return

Clip’em Cliff, Balance Sheet, For the Month Ended August 31, 2019. Assets: Cash $35,275, Accounts receivable 2,500, Interest Receivable 350, Supplies 250, Equipment 45,000 less Accumulated Depreciation: Equipment equals 42,500. Total Assets are $80,875. Liabilities: Accounts Payable 5,500, Income Tax Payable 3,400, Unearned revenue 2,100. Total Liabilities 11,000. Stockholders’ Equity: Common Stock 70,000, Ending Retained Earnings (125), Total Stockholders’ equity 69,875. Total Liabilities and Stockholders’ equity 80,875. Return

T-Accounts. Dividends has an August 16 debit entry of 150, an August 31 credit closing entry of 150 and a debit balance of 0. Service Revenue account has 3 entries on the credit side: August 10 4,000, August 17 5,200, and August 31 of 1,100. It has a debit closing entry on August 31 of 10,300. The total on the credit side is then 0. Interest revenue has an August 31 credit entry of 350, an August 31 debit closing entry of 350, leaving a credit balance of 0. Salaries Expense has an August 22 debit side entry for 4,600, a credit side closing entry on August 31 for 4,600, and a debit side balance of 0. Utilities Expense has a August 13 debit side entry for 75, an August 31 closing credit entry of 75, and a debit side balance of 0. Supplies Expense has a debit entry on August 31 of 50, a closing credit entry of 50 on August 31, and a debit balance of 0. Depreciation Expense: Equipment has a debit entry on August 31 of 2,500, a credit side closing entry on August 31 for 2,500 and a debit balance of 0. Income Tax Expense has a debit entry on August 31 of 3,400, a closing credit entry of 3,400 on August 31, and a debit balance of 0. Income Summary has a credit closing entry #1, for 10,650, a debit closing entry #2 for 10,625, leaving a 25 credit balance, a debit closing entry #3 for 25, leaving an ending balance of 0. Retained Earnings has a credit closing entry #3 for 25, a debit closing entry #4 for 150, leaving a balance of 125. Return

Clip’em Cliff, Post-Closing Trial Balance, August 31, 2019. Cash 35,275 debit. Accounts receivable 2,500 debit. Interest receivable 350 debit. Supplies 250 debit. Equipment 45,000 debit. Accumulated Depreciation: Equipment 2,500 credit. Accounts Payable 5,500 credit. Unearned Revenue 2,100 credit. Income Tax Payable 3,400 credit. Common Stock 70,000 credit. Retained Earnings 125 debit. Total debits and total credits are both 83,500. Return