General Insurance was controlled and conducted by General Insurance Corporation of India before the incorporation of Insurance Regulatory and Development Authority (IRDA) in 2002. General Insurance companies are to prepare accounts (Revenue) for each individual unit. General Insurance policies are issued for a short period, say, for a year, but it may be renewed. The Policies are issued at any date of the year.

In a general insurance, the liability of the insurer arises only when the insured suffers any loss caused by specific reasons and, consequently, he will be indemnified. If no loss is occurred question of compensation does not arise and the premium which was paid will not be carried forward for the next period; rather the same will be lapsed and will not be adjusted.

A marine insurance contract is an agreement by which the insurer undertakes to indemnify the assured in the manner and to the extent thereby agreed, against marine losses. In other words, it is a contract which protects the insured against losses on inland water or any land risk which may be incidental to any sea voyage—Sec 4(i). In short, this policy may cover a ship during buildings or the launch of a ship or any adventure analogous to a marine adventure.

Similarly, fire insurance means insurance against any loss caused by fire. Fire Insurance business means the business of effecting, otherwise than incidentally to some other class of business, contract of insurance against loss by or incidental to fire or other occurrence customarily included among the risks insured against in fire insurance policies — Sec. 2(6A).

It is other than Life Insurance, Marine and Fire Insurance.

Like Life Insurance Companies, in general insurance also from April 2000 a good number of private players have come into the field:

(a) Tate AIG General Insurance;

(b) Reliance General Insurance Company

(c) HDFC-Chubb General Insurance;

(d) Bajaj Alliance General Insurance Co. Ltd.;

(e) Royal Sundaram Alliance Insurance Co. Ltd.

(f) IFFCO Tokyo General Insurance Co. Ltd.

(g) ICICI Lombard General Insurance Co. Ltd.

(h) Export Credit Guarantee Corporation Ltd. etc.

In 1971, General Insurance Corporation of India was established which was the holding company of:

(i) National Insurance Co. Ltd.;

(ii) United India Insurance Co. Ltd. and

(iii) The New India Assurance Co. Ltd.

However, from Dec. 2000, GIC became The National insurer for General Insurance.

Thus, they are treated as independent Insurance companies.

Regulatory Framework:

While preparing and presenting accounts for Insurance companies various rules and regulations should be taken into consideration.

The following Acts and Regulations are to be considered:

(a) The Insurance Act, 1938;

(b) The Companies Act, 1956;

(c) The General Insurance Business (Nationalization) Act, 1972;

(d) The Insurance Regulatory and Development Authority, 1999;

(e) The Insurance Regulatory and Development Authority Regulations, 2002.

While preparing Receipts and Payments Account, Profit and Loss Account and the Balance Sheet of the Insurance companies, the recommendations of Indian Accounting Standards (A3) framed by the ICAI should strictly be followed as far as practicable, to the General Insurance Company with the exception of

(i) AS 3 (Cash Flow Statement) to be prepared under Direct Method only.

(ii) AS 13 (Accounting for Investment)—not to be taken into consideration.

(iii) AS 17 (Segment Reporting)—to be applied in general without considering the class of Security.

The financial statements of general insurance companies must be in conformity with the regulations of IRDA, Schedule B.

It has three parts: viz:

(a) Revenue Account;

(b) Profit and Loss Account, and

(c) Balance Sheet.

The Revenue Account of general insurance companies must be prepared in conformity with the regulations of IRDA, Regulations 2002, as per the requirements of Schedule B. It has already been stated above that separate Revenue Account is to be prepared for each individual unit i.e. for Marine, Fire, and Accident.

These individual revenue accounts will highlight the result of operation of each individual unit for a particular accounting period. It also reveals the incomes and expenditures of each individual unit. Like Revenue Account of a life insurance company, Revenue Account is prepared under Mercantile System of Accounting.

Items appearing in Revenue Account:

It has already been stated above that general insurance policies are issued for a short period, say, for a year. As a result, many of them may be unexpired at the end of the year. Therefore, the entire premium so received cannot be treated as an income for the current year only. A portion of that amount should be carried forward to the next year in order to cover the unexpired risks. This is what is known as Reserve for Unexpired Risks.

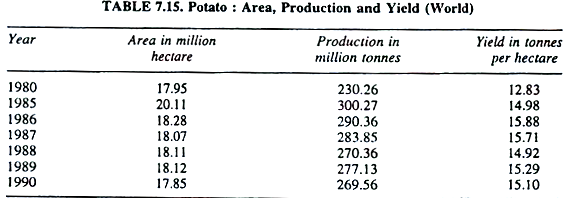

As per Schedule IIB of the IRDA the Reserve for Unexpired Risks should be provided for out of net premium so received as:

(a) 50% for Fire Insurance business;

(b) 50% for Miscellaneous Insurance business;

(c) 50% for Marine Insurance business other than Marine Hull business, and

(d) 100% for Marine Hull business.

In addition to the above, if any company wants to maintain more than this level, it can do so. The same is known as Additional Reserve.

Illustration 1:

Indian Insurance Co. Ltd. furnishes you with the following information:

(i) On 31.12.1996 it had reserve for unexpired risk to the tune of Rs. 40 crores. It comprised of Rs. 15 crores in respect of marine insurance business: Rs. 20 crores in respect of the fire insurance business, and Rs. 5 crores in respect of miscellaneous insurance business.

(ii) It is the practice of Indian Insurance Co. Ltd. to create reserves at 100% of net premium income in respect of marine insurance policies and at 50% of net premium income in respect of fire and miscellaneous income policies.

(iii) During 1997, the following business was conducted:

Indian Insurance Co. Ltd. asks you to:

(a) Pass journal entries relating to “Unexpired Risks Reserve”.

(b) Show in columnar form “Unexpired Risk Reserve” A/c for 1997.

Claims Incurred (Net):

It is the first item that appears in the expenditure side of the Revenue Account of an insurance company. Claims mean the amount which is payable by the insurer, to the insured for the loss suffered by the latter against which the insurance was made.

Claims can be divided into:

(a) Claims intimated but not yet accepted and paid;

(b) Claims intimated, accepted but not paid;

(c) Claims intimated, accepted and paid; and

(d) Claims rejected. But if there is only ‘Claims intimated’ the same is to be treated like (b). That is why, in order to find out the outstanding claims, claims that have been intimated (whether paid or unpaid) should be considered.

At the end of the year the entry for the purpose will be:

To Claims Intimated Accepted but Not Paid A/c

Claims Intimated but Not Accepted and Not Paid A/c

A reverse entry should be passed at the beginning of the next year for which there will be no effect in Claims Account. But, if any claim is rejected subsequently, the amount is to be transferred to Profit and Loss Account and Claims Account must be credited for the purpose.

Amount of claim to be charged to Revenue Account may be computed as:

Illustration 2:

From the following figures appearing in the books of Fire Insurance division of a General Insurance Company, show the amount of claim as it would appear in the Revenue Account for the year ended 31st March 1999:

Commissions:

Insurance Regulatory and Development Authority Act, 1999, regulates the amount of commission which is payable on policies to the agents.

Commission expenses is to be charged to Revenue Account of the General Insurance Company which is computed as:

Illustration 3:

Compute the amount of Commission to be charged to Revenue Account from the following particulars presented by a General Insurance Company as on 31st March 2009:

Operating Expenses:

Operating expenses will come under Schedule 4 of the Act. All revenue expenses—other than the commission and claims—will appear under this head.

Some of the operating expenses are:

Training Expenses; Rent, Rates and Taxes; Repairs; Printing and Stationery; Legal and Professional Expenses; Advertisement and Publicity, Interest on Bank Charges, etc.

In order to find out the overall performance or results of the operating of general insurance business Profit and Loss Account of the General Insurance Companies is prepared. It also takes into account the income from investment by way of interest, dividend, Rent Profit/Loss on sale of investments. Provision for Taxations and Provision for Doubtful Debts, if any, should also be provided for.

Similarly, other expenses related to insurance business and bad debts written-off also will be adjusted to this account. However, appropriation section of Profit and Loss Account will contain payment of interim dividend; proposed dividend; transfer to any reserve i.e. appropriation items.

The Balance Sheet of a general insurance company as per IRDA format is divided into two parts, viz. Source of Funds and Application of Funds. It is prepared in vertical form.

Sources of Funds:

It consists of:

(i) Share Capital (Schedule 5):

Various classes of Share Capital viz. Authorized Capital, Issued, Subscribed, Called-up and Paid up capital are separately shown.

(ii) Reserves & Surplus- (Schedule 6):

All kinds of reserves will appear under this head, viz. Securities Premium, Balance of Profit and Loss Account, General Reserve, Capital Redemption Reserve, Capital Reserve, etc.

(iii) Borrowings (Schedule 7):

Long term borrowings viz. Bonds, Debentures, Bank Loans, taken from various financial institutes will appear under this head.

Applications of Funds:

It consists of:

(i) Investments — (Schedule 8):

All kinds of investments, whether long-term or short-term, will appear under this schedule.

(ii) Loans— (Schedule 9):

Different kinds of loans clearly specified, viz. (a) Security-wise, Borrower-wise, performance-wise, and maturity-wise classification.

(iii) Fixed Assets (Schedule 10):

All fixed assets viz. Goodwill, Intangibles, Land and Building, Freehold/Leasehold Property, Furniture & Fixture, etc. will appear in this schedule.

(iv) Current Assets:

This section has two parts:

(a) Cash and Bank Balances (Schedule 11):

All cash and bank balances lying at Deposit Account and Current Account, Money-at-call and short notice etc. will appear in the Schedule.

(b) Advances and Other Assets (Schedule 12):

All advances (short-term) and other assets, if any, will appear in this Schedule.

(v) Current Liabilities (Schedule 14):

All current liabilities viz., Agents’ balances, Premium Received in Advance, Sundry Creditors, Claims Outstanding etc.

(vi) Provisions— (Schedule 15):

All kinds of provisions viz., Reserve for Unexpired Risk; Provision for Taxation, Proposed Dividend, Others.

According to Insurance Regulatory and Development Authority (Preparation of Financial Statements and Auditors’ Report of Insurance Companies) Regulations, 2002, every general insurance company must prepare as per Schedule B of the Regulations the following three statements for preparation and presentation of financial statements:

For General Insurance:

Revenue Account— Form B-RA

Profit and Loss Account — Form B-PL

Balance Sheet — Form B-BS

Thus, in short, every general insurance company is required to prepare a Revenue Account (Form B-RA); Profit and Loss Account (Form B-PL) and Balance Sheet (Form B-BS).

The prescribed formats which have been suggested by IRDA for preparing Revenue Account (Form B-RA), Profit and Loss Account (Form B-PL) and Balance Sheet (Form B-BS) are presented:

To Forms B-RA and B-PL:

(a) Premium income received from business concluded in and outside India shall be separately disclosed.

(b) Re-insurance premiums—whether on business ceded or accepted—are to be brought into account gross (i.e. before deducting commissions) under the head reinsurance premiums.

(c) Claims incurred shall comprise claims paid, specific claims settlement costs where applicable and change in the outstanding provision for claims at the year-end.

(d) Items of expenses and incomes in excess of one per cent of the total premiums (less Re-insurance) or Rs. 5, 00,000, whichever is higher, shall be shown as separate line items.

(e) Fees and expenses connected with claims shall be included in claims.

(f) Under the sub-head ‘Others’ shall be included items like foreign exchange gains or losses and other items.

(g) Interest dividends and rentals receivable in connection with an investment should be stated as gross amount, the amount of income tax deducted at source being included under “advance taxes paid and taxes deducted at sources”.

(h) Interest from rent shall include only the realized rent. It shall not include any notional rent.

(a) Incurred but Not Reported (IBNR), Incurred but Not Enough Reported (IBNER) claims should be included in the amount for outstanding claims.

(b) Claims include specific claims settlement cost but not expenses of management.

(c) The surveyor fees, legal and other expenses shall also form part of claims cost.

(d) Claims cost should be adjusted for estimated salvage value if there is a sufficient certainty of its realization.

(a) The extent to which the borrowings are secured shall be separately disclosed stating the nature of the security under each sub-head.

(b) Amounts due within 12 months from the date of Balance Sheet should be shown separately.

(a) Investments in subsidiary/holding companies, joint ventures and associates shall be separately disclosed; at cost.

(i) Holding company and subsidiary shall be construed as defined in the Companies Act, 1956.

(ii) Joint Venture is a contractual arrangement whereby two or more parties undertake an economic activity.

(iii) Joint control is the contractually agreed sharing of power to govern the financial and operating policies of an economic activity to obtain has benefits from it.

(iv) Associate is an enterprise in which the company has significant influence and which is neither a subsidiary nor a joint venture of the company.

(v) Significant influence (for the purpose of this Schedule) means participation in the financial and operating policy, decisions of a company, but not control of those policies. Significant influence may be exercised in several ways; for example, by representation on the board of directors, participation in the policymaking process, material inter-company transactions, interchange of managerial personnel or dependence on technical information. Significant influence may be gained by share ownership, statute or agreement.

As regards share ownership, if an investor holds, directly or indirectly through subsidiaries, 20 per cent or more of the voting power of the investee, it is presumed that the investor does have significant influence, unless it can be clearly demonstrated that this is not the case. Conversely, if the investor holds, directly or indirectly through subsidiaries, 20 per cent or more of the voting power of the investee, it is presumed that the investor does have significant influence, unless it can be clearly demonstrated that this is not the case.

Conversely, if the investor holds, directly or indirectly through subsidiaries, less than 20 per cent of the voting power of the investee, it is presumed that the investor does not have significant influence, unless such influence is clearly demonstrated. A substantial or majority ownership by another investor does not necessarily preclude an investor from having significant influence.

(b) Aggregate amount of Company’s Investments other than listed equity securities and derivative Instruments and also the market value thereof shall be disclosed.

(c) Investments made out of Catastrophe Reserve should be shown separately.

(d) Debt securities will be considered as “held to maturity” securities and will be measured at historical cost subject to amortisation.

(e) Investment property means a property (land or building or part of a building or both) held to earn rental income or for capital appreciation or for both, rather than for use in services or for administrative purpose.

(f) Investments maturing within twelve months from balance sheet date and investments made with the specific intention to dispose of within twelve months from balance sheet date shall be classified as short-term investments.

(a) Short-term loans shall include those which are repayable within 12 months from the date of balance sheet. Long-term loans shall be the loans other than short-term loans.

(b) Provisions against non-performing loans shall be shown separately.

(c) The nature of the security in case of all long-term secured loans snail be specified in each case. Secured loans, for the purposes of this Schedule, means loans secured wholly or partly against an asset of the company.

(d) Loans considered doubtful and the amount of provision created against such loans shall be disclosed.

(a) The items under the above heads shall not be shown net of provisions for doubtful amounts. The amount of provision against each head should be shown separately.

(b) The term ‘officer’ should conform to the definition of that term as given under the Companies Act, 1956.

(c) Sundry Debtors will be shown under item 9 (others).

(a) No item shall be included under the head ‘Miscellaneous Expenditure’ and carried forward unless:

1. Some benefit from the expenditure can reasonably be expected to be received in future, and

2. The amount of such benefit is reasonably determinable.

(b) The amount to be carried forward in respect of any item included under the head ‘Miscellaneous Expenditure’ shall not exceed the expected future revenue/other benefits related to the expenditure.

Illustration 4:

X Fire Insurance Co. Ltd. commenced its business on 1.4.2005 the year ended 31.3.2006:

Name of the Insurer: X Fire Insurance Co. Ltd.

Registration No. and Date of Registration with the IRDA

Illustration 5:

From the following information as on 31st March 2002, prepare the Revenue Accounts of Sagar Bhima Co.Ltd. engaged in Marine Insurance Business:

Other expenses and income:

Salaries— Rs. 2,60,000; Rent, Rates and Taxes— Rs. 18,000; Printing and Stationery — Rs. 23,000; Indian Income Tax paid—Rs. 2,40,000; Interest, Dividend and Rent received (net)— Rs. 1,15,500; Income Tax deducted at source— Rs. 24,500; Legal Expenses (inclusive of Rs. 20,000 in connection with the settlement of claims)—Rs. 60,000; Bad Debts— Rs. 5,000; Double Income Tax Refund— Rs. 12,000; Profit on Sale of Motor Car Rs. 5,000. Balance of Fund on 1st April 2001 was Rs. 26, 50,000 including Additional Reserve of Rs. 3, 25,000. Additional Reserve has to be maintained at 5% of the net premium of the year.

Tutorial Notes:

According to the question, we are asked to prepare a Marine Revenue Account. Accordingly, the expenses or incomes which are not related to this account are excluded. For this purpose, Profit on sale of Motor Car, Double Income tax Refund, Income-tax paid, Tax deducted at Sources, Bad Debts etc. are not considered at all for preparing Marine Revenue Account and their items are excluded. There are some authors who prefer to use Double Income-Tax Refund and Profit on Sale of Motor Car, as items of income and hence add them to Schedule 1.

Schedules Forming Parts of Financial Statements:

Illustration 6:

From the following balances extracted from the books of Perfect General Insurance Company Limited as on 31.3.2000, you are required to prepare Revenue Accounts in respect of Fire and Marine Insurance business for the year ended on 31.3.2000 and Profit and Loss Account for the same period:

The following additional points are also to be taken into account:

(a) Depreciation on Fixed Assets to be provided at 10% p.a.

(b) Interest accrued on investments Rs. 10,000.

(c) Closing provision for taxation on 31.3.2000 to be maintained at Rs. 1, 24,138.

(d) Claims outstanding on 31.3.2000 were Fire Insurance Rs. 10,000, Marine Insurance Rs. 15,000.

(e) Premium outstanding on 31.3.2000 were Fire Insurance Rs. 30,000, Marine Insurance Rs. 20,000.

(f) Reserve for unexpired risk to be maintained at 50% and 100% of net premiums in respect of Fire and Marine Insurance, respectively.

(g) Expenses of management due on 31.3.2000 were Rs. 10,000 for Fire Insurance and Rs. 5,000 in respect of Marine Insurance.

Illustration 7:

The following balances as at 31st Dec. 2009 have been extracted from the books of accounts of the General Insurance Co. Ltd.:

It is proposed that out of the profit Rs. 1, 00,000 be transferred to General Reserve and that a dividend @ Rs. 12% be provided for after making a provision of Rs. 2, 00,000 for Income Tax.

Claims intimated but not paid on 31.12.2009 were as under:

Fire Rs. 55,400; Marine Rs. 12,700; Miscellaneous Rs. 19,400.

Create 40% provision for unexpired risks in case of fire and miscellaneous insurance and 100% provision in case of marine business.

Prepare Revenue Account, Profit and Loss Account, and the Balance Sheet of the company.